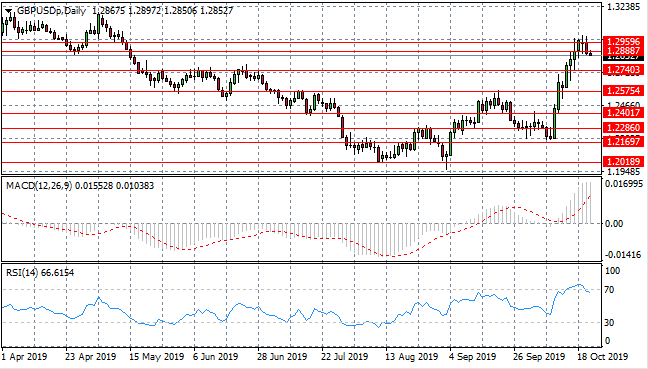

Bearish Reversal Underway For GBP/USD

- 23 Oct 2019

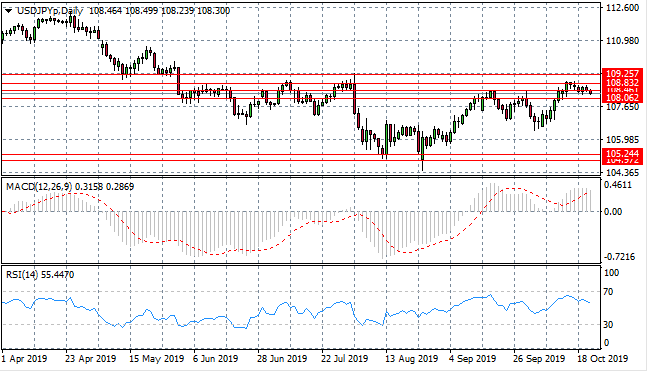

USD/JPY

The USD/JPY pair has failed to break the 108.83 resistance line which has resulted in a number of small-bodied candles oscillating in a very tight trading range. Price action is likely to remain in the 108 price range. Momentum indicators are beginning to pull back from bullish territory.

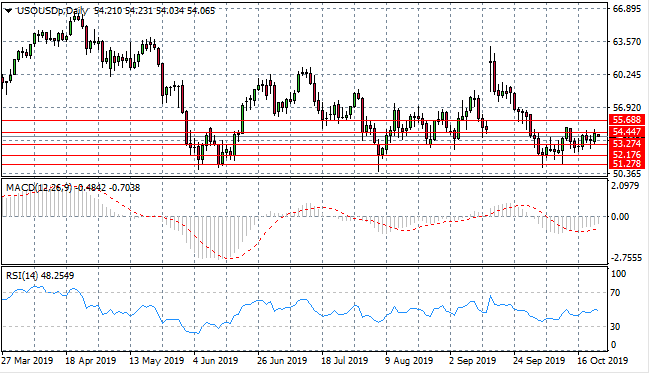

EUR/USD

The Eurodollar has broken and fallen back to the 1.115 support line. Price action may now head back towards the 1.112 support level once again as sellers return to the pair. Momentum indicators remain bullish with MACD breaking the zero line, however, RSI is pulling back from overbought conditions.

GBP/USD

The GBP/USD pair has climbed once again to the 1.295 resistance line but has since rejected the resistance area. The result has been a break in the 1.288 support level. The next support level remains at the 1.274 price line. Momentum indicators are in bullish territory, yet RSI has pulled back to break the overbought line.

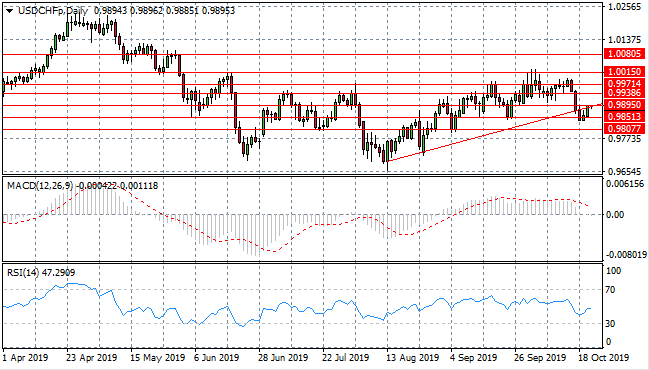

USD/CHF

The USD/CHF pair has pulled back once again to break the 0.985 support level and the ascending trendline. This move has, however, inspired the return of buyers. Price action continues to test the ascending trendline and now the 0.989 resistance level. Momentum indicators have downward trajectories although RSI is making a moderate recovery from oversold conditions.

USD/CAD

The USD/CAD pair has rebounded from the 1.307 support level as a new trading range is being established. The 1.307 support level has been established as a new price floor. Momentum indicators are bearish, yet RSI is recovering from oversold conditions.

SILVER

Silver has moved through the apex of a symmetrical triangle which should result in a bullish breakout given the previous trend was bullish. Instead, the metal is languishing at the 17.42 support level with a series of doji candles indicating that there is indecision. Momentum indicators remain in bearish territory.

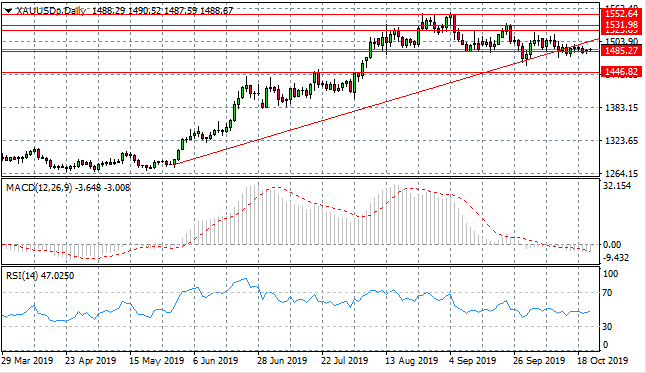

GOLD

Gold has been trading horizontally, within a tight trading range recently. Price action has broken the ascending trendline, which indicates sentiment has turned bearish. Price action continues to test the 1485.27 support level and sellers have been unable to breach this support level. Momentum indicators remain in neutral/bearish territory.

OIL

WTI is now testing the $54 per barrel price range which has represented a recent resistance area. There is a moderate uptrend in the commodity with higher lows and higher highs. The $55-60 per barrel range would be a stabilizing price, yet any further geopolitical tensions will likely result in more price volatility. Momentum indicators have upward trajectories.