WTI Extends Losses To Approach $60 Per Barrel Range

- 23 May 2019

Kickstart your new year with the best USD50 bonus campaign. Limited-time offer! Get it now!

USD/JPY

The USD/JPY pair is testing the 110.28 price level as the Dollar stalls mid-recovery. The 110.63 price level has developed as a resistance level for the pair and therefore a target for buyers. Momentum indicators are mixed; with MACD approaching the zero line to the upside and RSI stalling in bearish territory.

EUR/USD

The EUR/USD pair is languishing in ‘no man’s land’ within the 1.113 and 1.119 trading range. A series of small bodied candlesticks highlight indecision in the pair. Momentum indicators remain in bearish territory with MACD extending into negative territory and RSI flattening just above the 30 support level.

GBP/USD

The GBP/USD pair has broken yet another support level at the 1.271 price line as fundamental factors take hold in the pair. Momentum indicators confirm the bearish bias; with MACD extending into bearish territory and RSI breaking the 30 support level to the downside.

USD/CHF

The USD/CHF pair has pulled back to the 1.010 price level and price action has stalled just below this resistance level. The next support level is the ascending trendline, where price action has tended to turn bullish on previous occasions. Momentum indicators are mixed with MACD approaching the zero line and RSI flattening in moderately bearish territory.

USD/CAD

The USD/CAD pair has found strong resistance around the 1.345 price level and as such price action has begun to fall away from the resistance line maintaining the 1.330- 1.345 trading range. Momentum indicators have remain moderately bullish reflecting the bullish bias in price action.

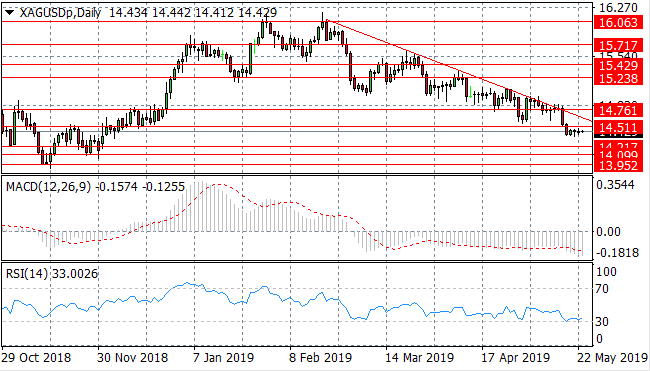

SILVER

Silver sellers have pushed price action to break the 14.51 support level where sellers have stalled. This support level has provided resistance on previous occasions dating back to last year. Momentum indicators reflect a bearish bias with MACD moving further into negative territory and RSI bouncing along the 30 support line.

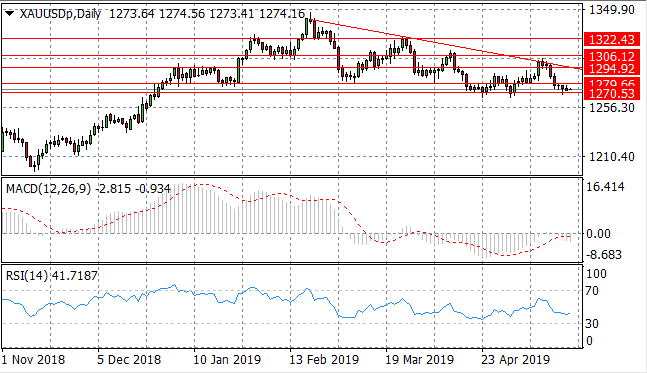

GOLD

Gold is maintaining the bearish trend over the longer term and has reached a strong support area at the 1270.53 price line. On previous occasions buyers have returned to the metal at this support level and price action has turned bullish. Momentum indicators have turned bearish; with MACD extending its position below the zero line and RSI beginning a downward trajectory towards the 30 support level.

OIL

WTI buyers had a short run as sellers have begun to win the battle of price action. The commodity has broken an ascending trendline which may be significant in determining the longer-term trajectory of the pair. The target price level for sellers is the $60 per barrel range. MACD has flattened at the zero line and RSI has stalled in bullish territory.

Follow Us on Facebook: