Another Bullish Retracement For The USD/CAD Pair?

- 26 Nov 2018

USD/JPY

The USD/JPY pair has begun a bullish revival once again and is approaching the 113.25 price level. Momentum indicators remain mixed; with MACD approaching the zero line to the downside however, RSI has hit the default line which suggests that momentum is not excessively bullish.

EUR/USD

The EUR/USD pair suffered another mild sell-off in recent trading which has resulted in the pair falling back below the 1.142 price level. The next price target is the 1.129 support line. MACD has extended its position in bearish territory and RSI has crossed the default line to the downside.

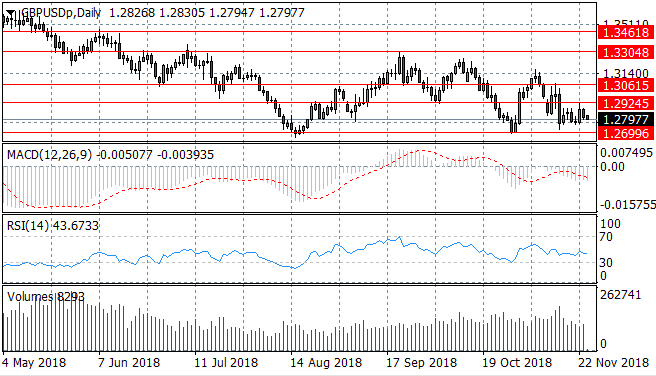

GBP/USD

Fundamental factors influenced the recent sell-off in the GBP/USD pair and these factors continue to put pressure on the Pound. The pair is consolidating mid trading range where the 1.269 price level remains the floor. Momentum indicators remain bearish with MACD extending the bearish position and RSI continuing the descending trajectory.

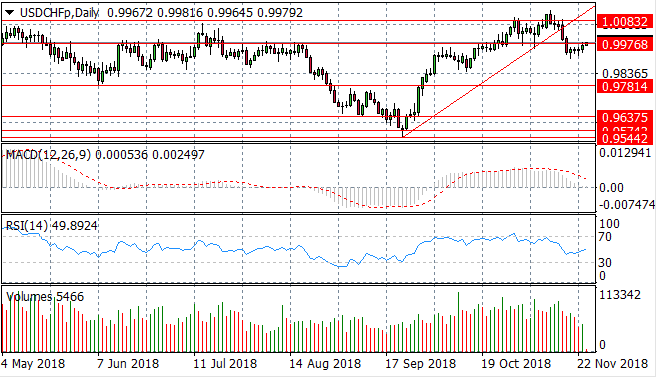

USD/CHF

The USD/CHF pair has broken the 0.997 price level to the downside which appears to have inspired buyers to return to the pair. A series of doji candles indicates indecision as neither buyers nor sellers have the conviction to drive price action. Momentum indicators are mixed with MACD approaching the zero line and RSI approaching the default line with bullish momentum.

USD/CAD

The USD/CAD pair has once again retraced from the ascending trendline after a short-lived break of the support line. Will buyers have the conviction to drive price action towards the 1.326 price level once again? RSI has pulled back from overbought conditions and MACD remains in strongly bullish territory.

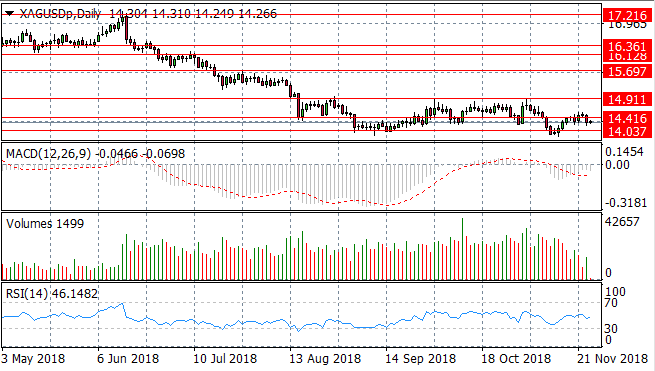

SILVER

Silver has rebounded from the 14.03 price level to maintain a recent trading range between the 14.03 and 14.91 price levels. The metal continues to bounce around the 14.41 price level. A series of small-bodied candles indicate neither buyers or sellers are dominating the commodity therefore it will likely consolidate within range.

GOLD

Gold has once again undergone a bullish retracement from the ascending trendline at the 1191.58 price level and as a result, is testing the 1231.10 price level. Momentum indicators are mixed with MACD touching the zero line and RSI breaking the 50 default line. Given the struggle the metal has had to break this resistance level, price action will be more likely to head back towards the 1209.70 support line.

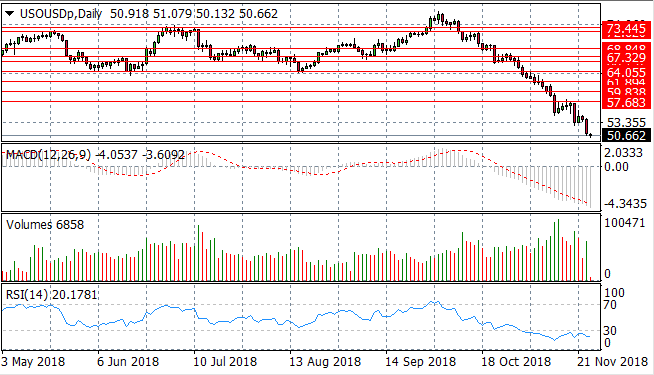

OIL

Oil appears to have entered into a descending flag pattern, with price action making small retracements followed by strong sell-offs. MACD continues to extend into bearish territory and RSI continues to bounce along just beneath the 30 support level. Volume has spiked once again as sellers dominate the commodity.