Australian Dollar Reaches Key Levels

- 15 Nov 2017

AUD/USD

The AUD/USD pair has dropped below previous support levels to reach an oversold position. The move illustrates the general sentiment around the Australian Dollar, as the RBA elect to keep interest rates on hold and the imminent rise in the Fed Funds rate lessens the yield advantage for investors holding Australian government bonds. Coupled with this, low wage growth in Australia and rising risk sentiment in global markets has resulted in AUD weakness. As a result, the pair is now testing the 30 support level on RSI which could suggest that a bullish reversal is possible, however will require some positive fundamentals data.

Impact event: U.S. Core Retail Sales and Core CPI data will be released at 15:30 GMT+2 and will impact U.S. dollar pairs.

AUD/CAD

After breaking the support level at 0.971, the AUD/CAD pair has continued to test the lower Bollinger band with a strong bearish candlestick in yesterday’s session breaking the lower bound. RSI is close to reaching the 30 support level with a sharp downward trajectory. Clearly, the pair has reached oversold conditions which could indicate that a bullish reversal is imminent, as yet, there are no current signs of a trend reversal.

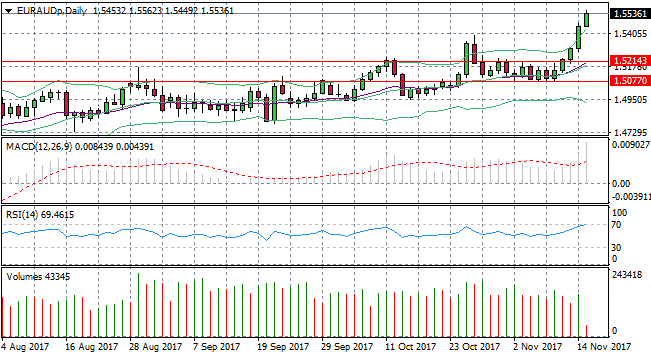

EUR/AUD

Strong fundamentals data from the Eurozone has continued to provide support for the Euro especially against the Australian dollar. The EUR/AUD pair has surged to break the upper Bollinger band in the two previous trading sessions, resulting five consecutive bullish trading sessions. RSI has hit the 70 oversold zone however, a bearish reversal may not be imminent especially considering there is fundamentals data backing Euro strength.

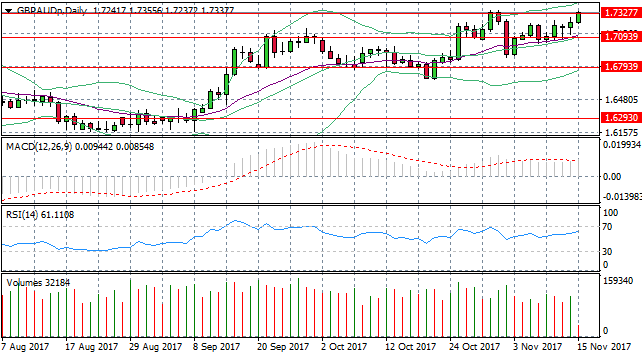

GBP/AUD

Australian Dollar weakness persists even against the British Pound despite the Pound suffering in recent trading sessions. The pair is now testing a previous market high at the 1.732 price level, which seems unlikely to break when reviewing momentum indicators. MACD has flattened in mildly bullish territory and RSI is approaching the 70 oversold zone and in this case, fundamentals do not necessarily support British Pound strength.