The Australian Dollar Tests Key Levels

- 28 Mar 2018

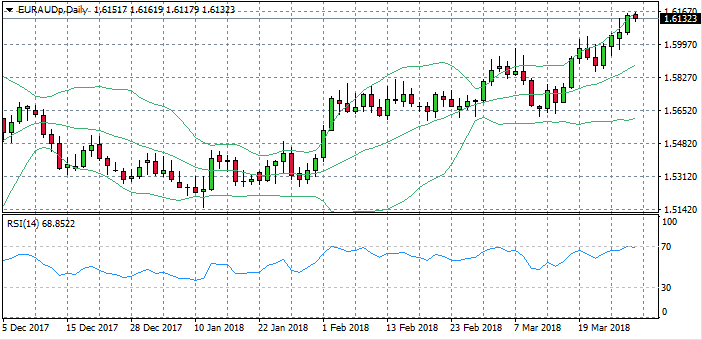

EUR/AUD

The EUR/AUD pair has reached overbought conditions, however, there are signs of a reversal. A bearish candle at the top of the bullish move could signal a change in price momentum. RSI has also reached overbought conditions and has stalled at the 70 resistance line.

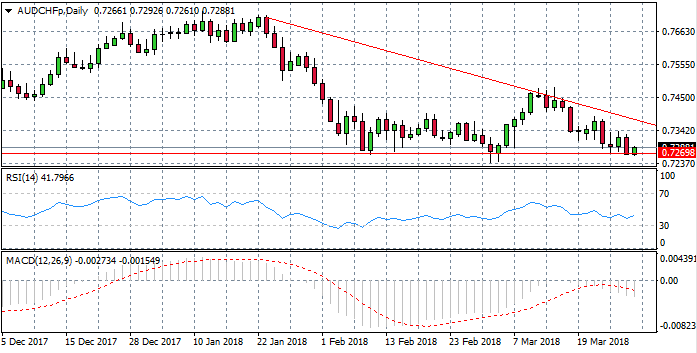

AUD/CHF

The AUD/CHF pair has entered into a descending triangle formation which highlights a potential long-term bearish bias. Oscillations have become smaller with progressively lower highs. A breakout from the bottom trend line would confirm bearish momentum. MACD confirms the bearish bias.

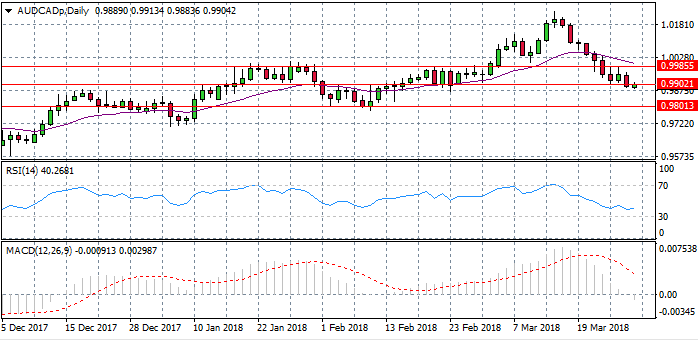

AUD/CAD

The AUD/CAD pair has entered into a downtrend, the question is: will it continue? The pair has reached a significant resistance area at the 0.990 price line and a break here would send prices toward the 0.980 price level. However, since the break, price action has turned bullish. Momentum indicators may give a clue: both have a downward trajectory and MACD has just broken the zero line to the downside.

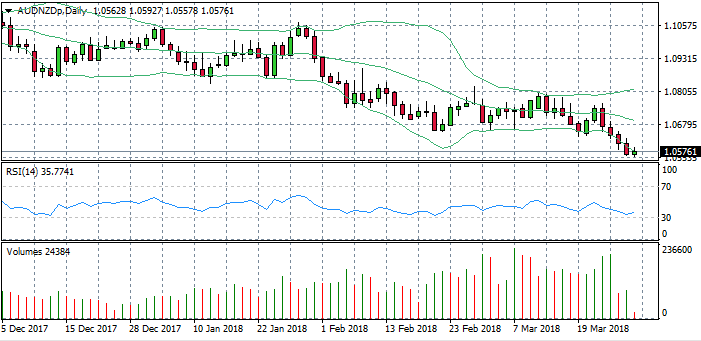

AUD/NZD

The AUD/NZD has reached oversold conditions as it appears sellers have lost the conviction to push prices lower. Volume has been declining in recent trading sessions which has culminated in some buying activity. A doji candle in today’s trading could be a signal for a reversal, after several breaks of the lower Bollinger band. RSI indicates a bullish momentum reversal.