Daily Insights Report 12/07/2017

- 12 Jul 2017

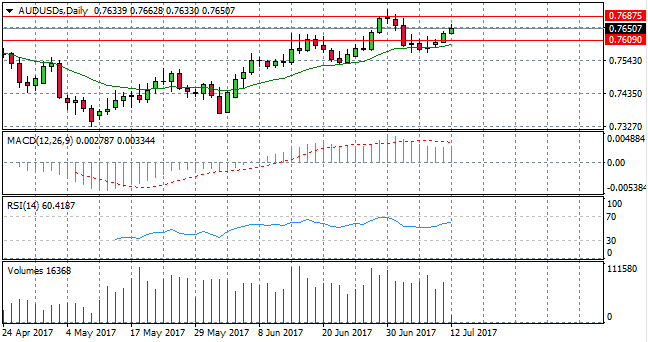

AUD/USD

The AUD/USD pair has broken through a fairly significant resistance area at the 0.760 line and appears to be heading towards a recent market top at the 0.768 line. Sentiment is bullish denoted by MACD, which is in positive territory. The recent bullish move has resulted in rising volume, indicating there is still significant buying interest in the pair. However, RSI is reaching the overbought area which could indicate that the uptrend will lose steam soon. Price action will have to break the market top at 0.768 for a strong bullish trend to be confirmed.

Impact event: Federal Reserve Chair Janet Yellen testifies at 17:00 GMT+3 and comments regarding the economy could impact dollar pairs.

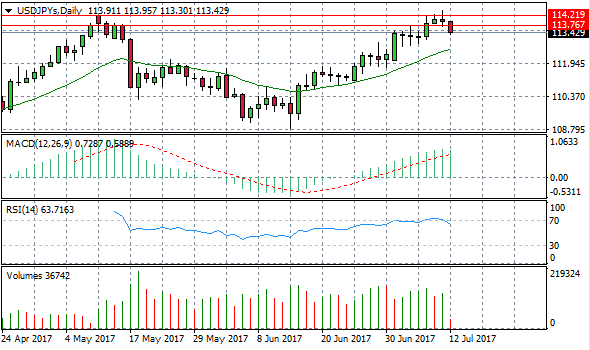

USD/JPY

The USD/JPY has broken a support area at 113.76 having bounced off the market top at the 114.21 level. The question is whether this move marks the end of a ascending flag continuation pattern. The strong bearish move is confirmed by RSI which has moved away from the overbought area at 70 and now has a downward trajectory. The 20-period exponential moving average still has an upward trajectory and price action is currently above the EMA indicating that sentiment is still bullish. This is confirmed by MACD remaining strongly in positive territory, however, it is a lagging indicator.

GOLD

Gold has entered into a descending channel with price action bouncing off the upper trend line on approximately three previous occasions. The current resistance level for the upper trend line is at 1224.59 for the current trading session. However, the pair must first break a resistance zone the 1222.33 level. If the pair is able to break through the series of resistance levels, a strong bullish reversal is indicated. However, the probability of the pair bouncing back from the upper trend line is high, as price action has failed to break resistance on several previous occasions. MACD remains below the zero line and RSI is in the oversold area with a moderate upward trajectory.

Impact event: Federal Reserve Chair Janet Yellen testifies at 17:00 GMT+3.

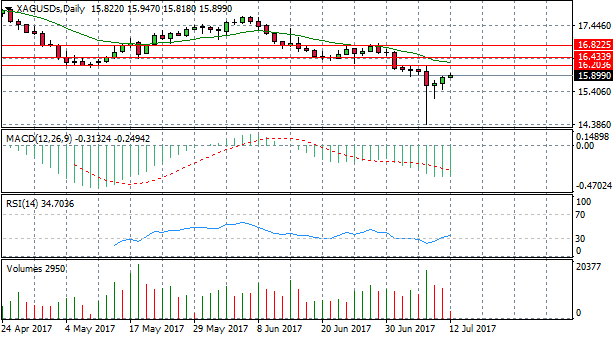

SILVER

After an accidental sell-off for the metal on the 7th July 2017, Silver prices have made a moderate recovery. Yesterday resulted in the first candle to close above the 30 zone on RSI which can be a bullish indicator. However, MACD is still negative. A bullish reversal will only be indicated when MACD crosses the zero line. The next target for price action is the 16.20 level. Notably, the 20-period EMA has a downward trajectory which could signal that bullish momentum may be unsustainable. Volume also appears to be declining into the move.