The Dollar Is Buoyant Ahead Of NFP Later Today

- 8 Dec 2017

USD/JPY

The USD/JPY had a strong bullish breakout in yesterday’s trading session and is bullish today, ahead of the NFP. A break of the 113.15 price level indicates the pair has moved beyond a previous support level. The break of the 20-period EMA and the sharp approach towards the zero line on MACD indicates dollar strength going into the employment data release later today.

Impact event: The Non-Farm Payroll report will be released today at 15:30 GMT+2 and will impact all USD pairs.

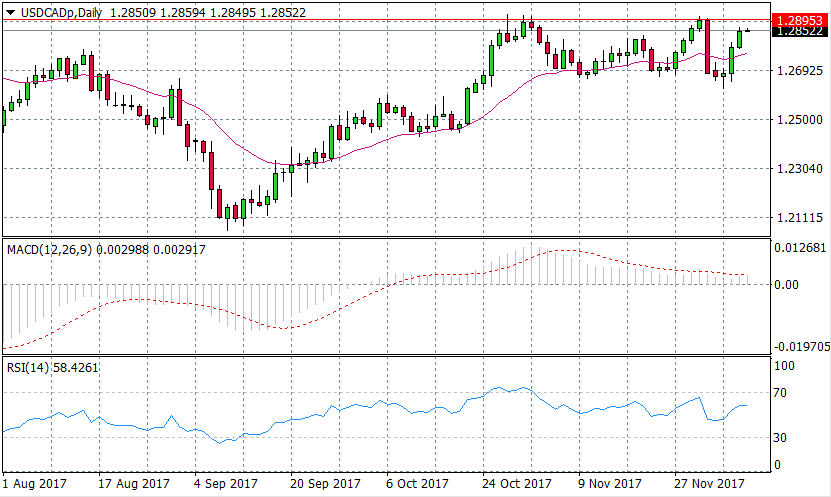

USD/CAD

The USD/CAD pair has broken the 20-period EMA to the upside and is approaching the 1.289 price level. However, there are signs that the move is losing steam as momentum indicator suggest that bullish momentum is stalling; MACD is flat and only moderately bullish and RSI has flattened just above the 50 support level. Fundamental factors later in the day will likely impact the pair’s near-term direction.

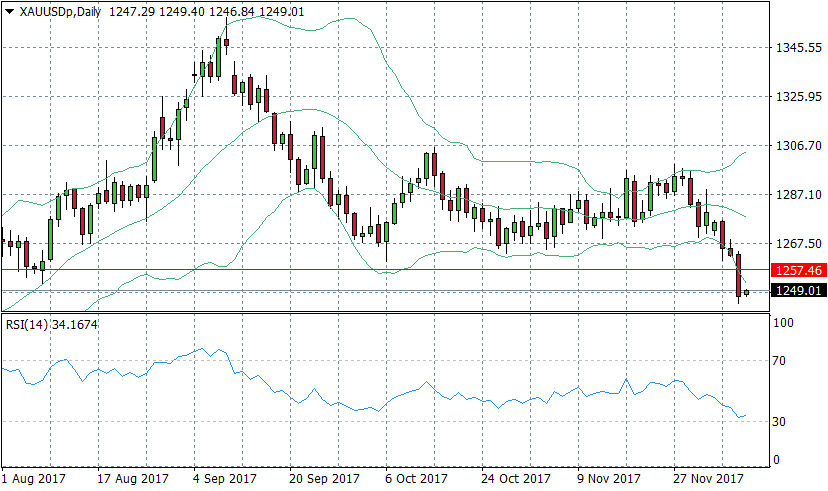

GOLD

As discussed in yesterday’s Insights Report, Gold has now begun to show signs of a bullish reversal despite U.S. Dollar strength. A bullish candle to start today’s trading session has been coupled with a sharp turn in momentum on RSI. The oscillator hit the 30 support level and bounced back in a bullish direction. The question is: will there be enough support from Gold buyers?

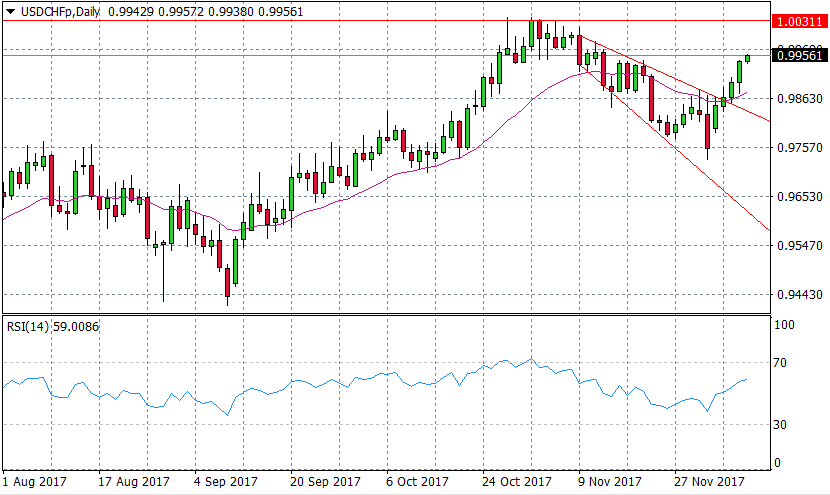

USD/CHF

The USD/CHF has broken out of a downward channel and has pushed beyond the 20-period EMA. A market top sits at the 1.003 price level and with RSI displaying a sharp upward trajectory, there may be further upside. Employment data being released later on during the trading session will determine buyers’ appetite for the Greenback.