Euro Dominates Price Action On Tuesday Trading

- 20 Mar 2018

EUR/GBP

The EUR/GBP pair has stalled at the 0.879 price level which also represents the 23.6 Fibo level indicating a retracement may be imminent. Heavy buying pressure in yesterday’s trading indicates that the recent sell-off may be coming to an end. Clearly, the 0.879 price level is significant and a rejection will likely result in the resumption of the previous uptrend. RSI appears to be undergoing a momentum reversal.

Impact event: U.K. CPI data will be released at 11:30 GMT+2 and will impact all GBP pairs.

EUR/NZD

The EUR/NZD pair has entered into an ascending triangle pattern and is currently testing the upper trend line; this formation is generally found ahead of a bullish breakout. A breakout seems imminent as both MACD are in bullish territory with upward trajectories and price action follows the pattern of higher lows.

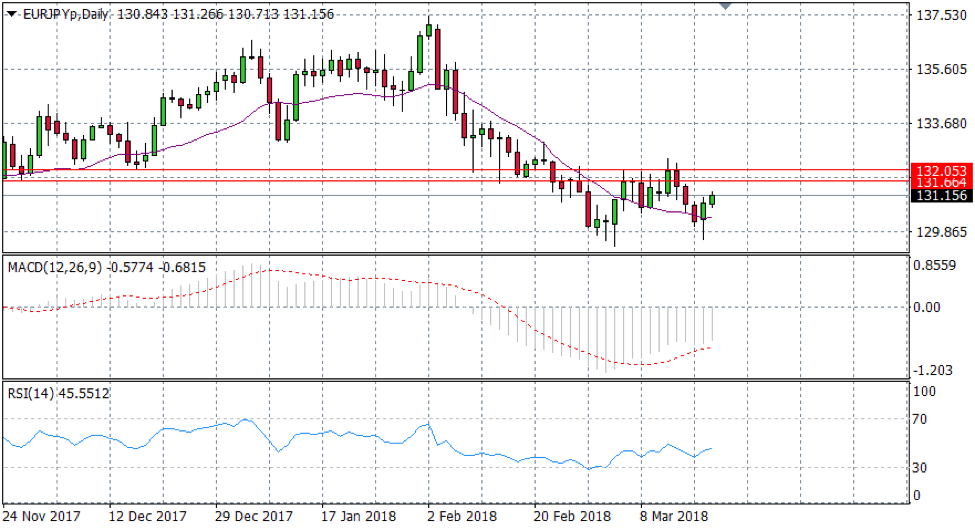

EUR/JPY

The Euro continues its dominance over the Japanese Yen, with a break of the 20- period EMA. Buying pressure in yesterday’s trading started the current bullish move. Momentum indicators suggest that momentum has turned bullish with a reversal on MACD and an upward trajectory on RSI. The next price target for buyers is likely the 131.66 price line which represents a previous (moderate) resistance level.

USD/CAD

The USD/CAD pair appears to be on the verge of a reversal denoted by a doji candlestick in yesterday’s trading. MACD is stalling in bullish territory and RSI has hit the 70 overbought line and has flattened. All indications suggest that buyers may have lost steam and lack conviction to push prices higher.