The Euro Dominates Trading On Monday

- 5 Mar 2018

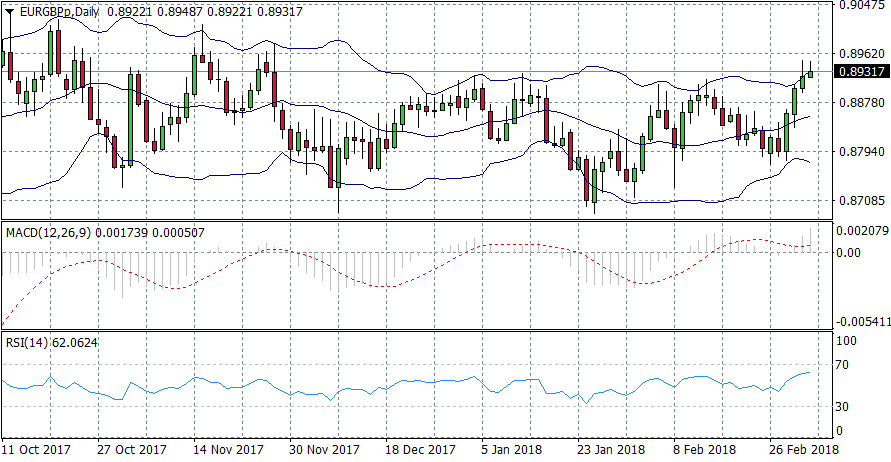

EUR/GBP

The EUR/GBP pair has reached overbought conditions, several break of the upper Bollinger band suggest the bullish move may be short-lived. At the same time RSI is approaching the 70 zone and recent candlesticks indicate selling pressure has risen. MACD remains in positive teritory which may suggest there is room for further upside in the pair and the advance is beginning to slowdown.

Impact event: U.K. Markit Services PMI data will be released at 11:30 GMT+2 and will impact all GBP pairs.

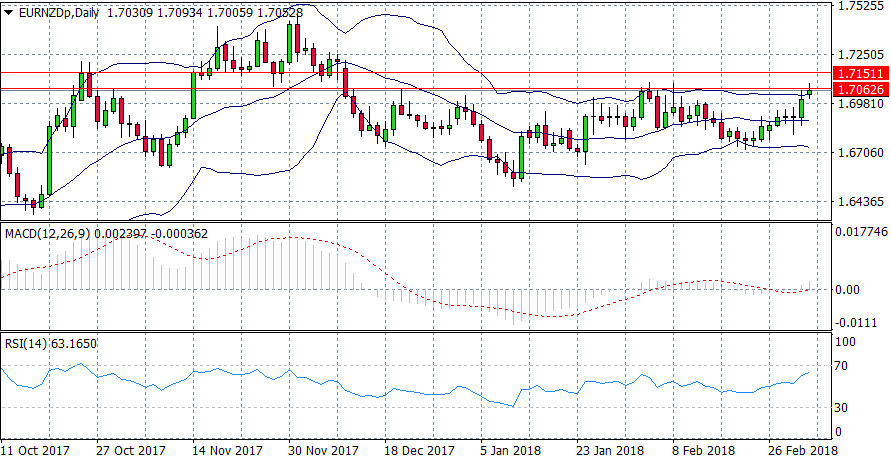

EUR/NZD

The EUR/NZD pair is testing both the upper Bollinger band and a fairly significant resistance line at the 1.706 price level. There appears to be room for further upside as momentum indicators display an upward trajectory and MACD has broken the zero line. Price action may push towards the 1.715 price level, however, if the current resistance are is rejected, the pair will likely continue to trade in range.

EUR/JPY

The EUR/JPY pair appears to be decelerating its sharp downward move since the beginning of February. A series of doji candlestick at the bottom of the dontrend suggest indecision and therefore a potential reversal. RSI has reached oversold conditions and has flattened at the 30 zone whilst MACD remains in strongly bearish territory. Fundamental factors are likely to determine near-term direction for the pair.

EUR/AUD

The EUR/AUD pair has had several breaks of the upper Bollinger band since breaking the 1.572 price level. A the same time, RSI has hit the 70 resistance line. Selling pressure appears to have increased, however, MACD indicates that momentum remains bullish. A momentum reversal on RSI and a break of the upper Bollinger band to the downside would be required to initiate the full price reversal.