Euro Weakened By ECB Cautious Move

- 27 Oct 2017

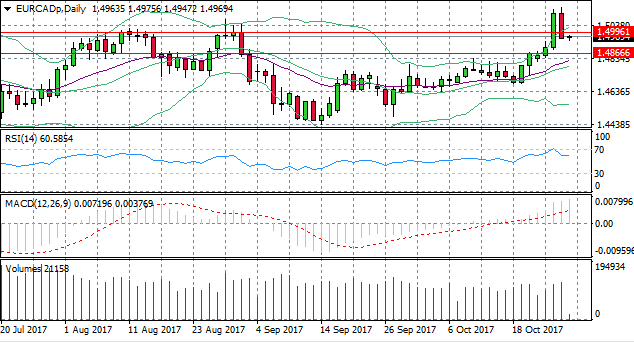

EUR/CAD

The EUR/CAD pair has retraced back below a previous price high at the 1.499 price level. At the same time, RSI has bounced back from the overbought conditions at 70. The next obvious support level is the 1.486 price line, however, there are indications from several momentum indicators that sentiment is still bullish.

EUR/AUD

The EUR/AUD is testing the 1.521 price level after having broken the resistance line in yesterday’s trading session. ECB President Mario Draghi announced a scaling back of the bank’s asset purchasing program, however, it was seen as a cautious move which resulted in a sell-off in the Euro. Overall, momentum indicators suggest that sentiment remains bullish, therefore the question is whether sellers have the conviction to drive prices to the 1.507 price line.

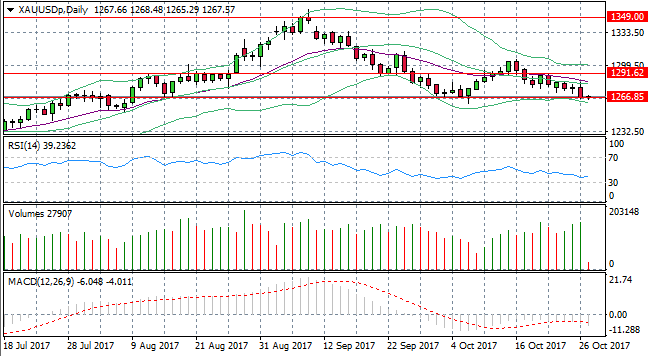

GOLD

Gold prices are testing the 1266.85 support line after a sell-off yesterday which may have been due to negative sentiment towards the Euro and more positive sentiment towards the U.S. dollar. RSI is heading close to the 30 oversold line yet MACD remains below the zero line. Rising volume into the bearish move may indicate that sellers have the conviction to push prices below the 1266.85 price level.

GBP/CAD

The GBP/CAD is testing the 1.690 price level, with the next target the 1.683 price level. Momentum indicators appear to be mixed, with RSI turning more bearish yet MACD extends its move into bullish territory. Volume appears to be declining which may suggest buyers are leaving the market after pushing prices to beyond the previous price high.