Low Volatility Ahead of European Trading Session

- 5 Oct 2017

GBP/JPY

The GBP/JPY daily chart shows the pair testing the 20 period EMA which appears to be acting as a support level for the pair. If it breaks, the next price target will be the 147.511 price level. MACD and RSI indicate that momentum is starting to turn bearish with both having downward trajectories.

AUD/USD

The AUD/USD currency pair has reached a significant support level at the 0.781 price level. Momentum indicators suggest that there is still room for further downside with MACD breaking the zero line and RSI approaching the 30 oversold area. However, a bullish reversal may be imminent.

EUR/GBP

The EUR/GBP pair is testing the 20-period EMA and Bollinger band mid-line, with a break potentially sending the pair to the 0.892 price level. MACD indicates that sentiment has turned more bullish with a sharp upward trajectory. RSI however, has flattened at the mid-line. A break is required to establish a trend.

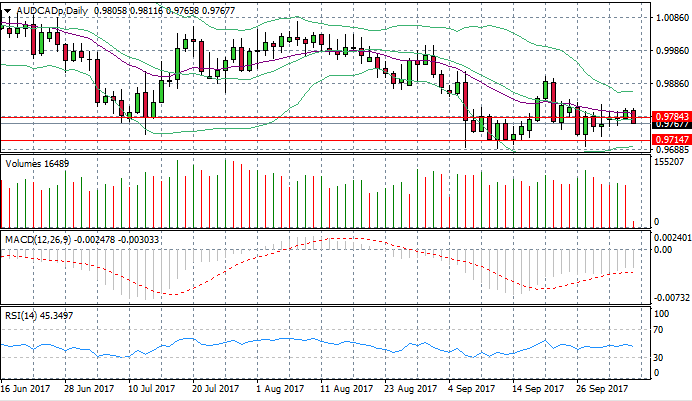

AUD/CAD

AUD/CAD prices have broken the 0.978 price level and the 20-period EMA to the downside, with volume sustained during the break, highlighting interest in the pair. The break will likely send price action towards the 0.971 price level as sellers dominate. Both MACD and RSI indicate that sentiment has turned bearish in the last trading session.