Daily Insights Report 03/02/17

- 31 Mar 2017

3 Feb 2017

The Dollar recently lost some of its value. The yield on 10-year T bills fell below 2.50%, the first time since November. The coming weeks of economic data, in addition to a more clear picture about which way the US policy will move. Since the new President came in to office, the Dollar appreciated strongly in the first few days. Since then, the value of the Dollar has stagnated. This suggests that the Dollar is looking for new ways to keep growing, or reached a high for now. The Dollar has dropped 0.4% in the Dollar index (weighed with 10 currencies).

A big question for the Dollar is the matter of the Treasury-Secretary nominee. Investors are not sure which direction the Dollar will move since there is no official person to discuss currency policy.

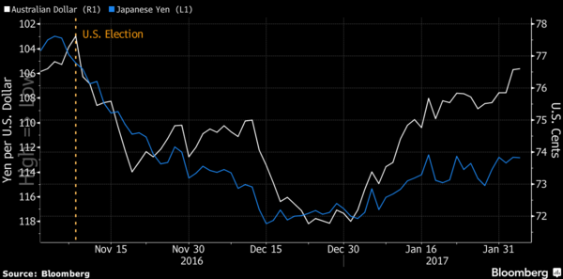

The most notable performers in the last few days include the AUD and JPY. The AUD has reached a new high from the time of the US election. The JPY has found some traction and stability after the yield on bonds have slightly been lifted. The graph below compares how the currencies have performed since the election.

Commodities

– West Texas Intermediate (WTI) crude rose by 0.75% to reach a price of $53.89 per barrel. The price of oil has risen for the last three weeks. This is likely due to the assumption that OPEC has cut more than half of the supply that they intended to cut.

– The price of gold fell 0.2% and traded at $1,213.25. It has gained 1.88% this week alone.

United States Dollar (USD)

ISM Non-Manufacturing Index

Demand from the services industry could keep January’s data to almost the same level of Decembers (which was a 14 month high). While the US economy continues to push through the recovery period, spending on services remains above 2.0% which shows a healthy level of spending.

Employment Report (January)

Recently, the data and current political situation in the US has created a murky picture for investors. A strong jobs report will be key to show the US economy has traction. Should the jobs data show to be healthy, it is likely to give investors a bullish idea about the Dollar. The unemployment rate is expected to be 4.7%. As a result of the job growth, unemployment insurance claims have been very low. Nonfarm jobs have slowed in growth, but are in line with population data – so it is acceptable. As the economy pushes through a recovery period and eventually into an expansion phase (assumed by the Federal Reserve to come this year) real wages should rise as a result.

Technical Analysis

USDJPY

This trade continues to move in the direction opposite to what traders believed t the beginning of the year. The currency reached a high of 118.70 in mid-December but is currently trading around 112.80. With the US yield curve flattening and a downtrend with this pair, it is likely to continue if other things remain at the same pace. If looking at an hourly chart, there is a potential descending triangle. For a short term trader who is bearish on the Dollar, it may be a good time to take on a position with this pair towards 115.50 per Dollar. The moving averages are both facing downwards while the stochastic indicators show that the currency pair is also overbought.