Daily Insights Report 24/04/17

- 24 Apr 2017

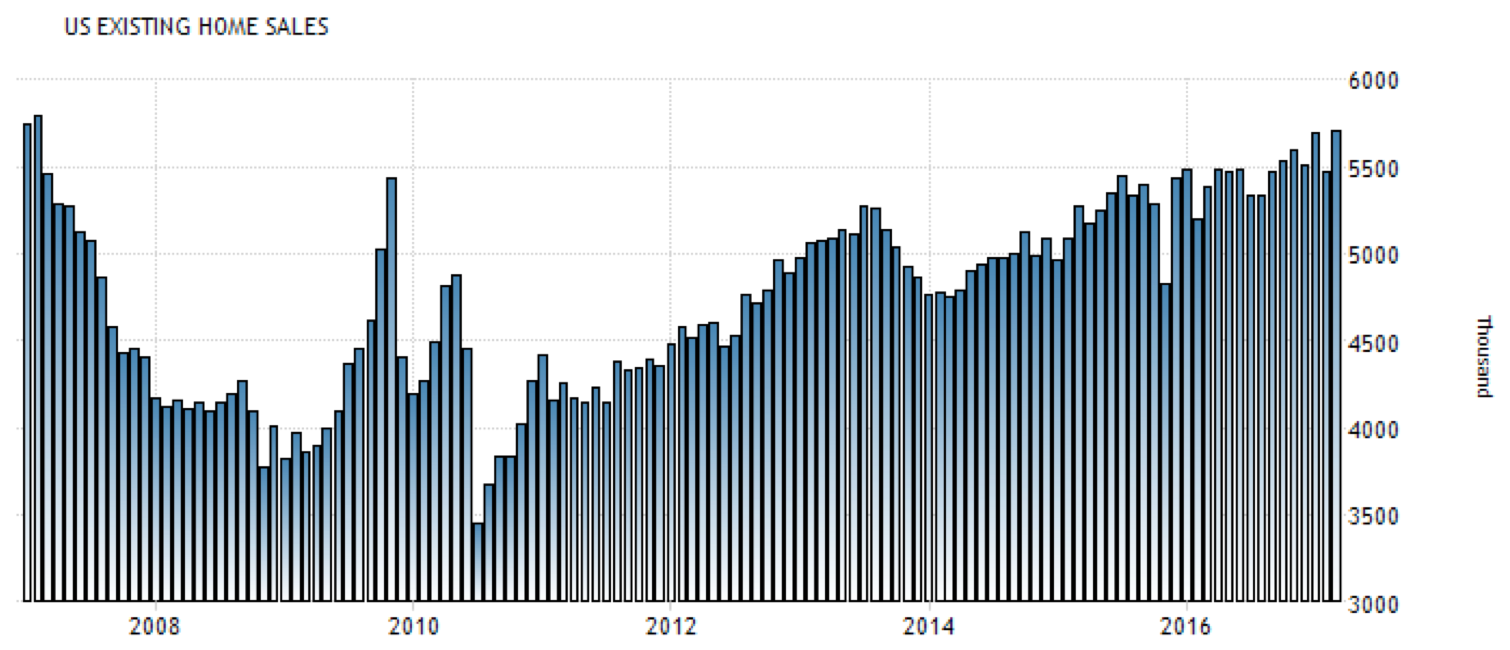

The US existing home sales reached a 10-year high. Sales of previously owned houses in the US jumped 4.4% month-over-month to a seasonally adjusted annual rate of 5,710,000 in March. This beat the market expectations of 5,600,000. It is the highest value seen since February 2007 due to a 4.3% rise in sales of single family houses and a 5.0% gain in condominiums. How this data has changed in recent years can be seen in the chart below.

– The Euro opened in high trading as opinion polls showed Emmanuel Macron, investor’s preferred candidate, likely to beat Marine Le Pen, the far-right leader, in the second round of French elections. Mr. Macron, who is a centrist that supports open markets and France to stay in the EU, took 23.8% of Sunday’s first-round vote ahead of Ms. Le Pen’s 21.7%. As a result, the Euro jumped $0.02 against the Dollar when the results were released – pushing the Euro above $1.09 for the first time in five months. The Euro showed similar gains against other major currencies including the Japanese Yen and British Pound.

Commodities

– By the end of last week, oil was set for the biggest weekly drop in a month as market confidence in OPEC’s ability to overpower a resurgent US shale industry wavered. Friday saw West Texas Intermediate (WTI) crude to fall below $50, to reach $49.39. Similarly, Brent was down as well, after falling $1.24 to reach $51.75.

– Gold opened quite lower at the beginning of the trading day. It was down 1.5% at $1,266 an ounce, before going back up to $1,273 an ounce.

Japanese Yen (JPY)

Monetary Policy (April)

Later this week, the Bank of Japan is set to keep its monetary policy unchanged for the third time this year. The recent uptick in commodity prices has caused inflation to rise for the first time since 2015. However, it is not likely that inflation will reach the Bank of Japan’s target of 2.0%. Similarly, the Yen’s depreciation is improving exports, and consumer and business sentiment have both seen improvements. For this reason, the Bank of Japan is likely to keep its monthly bond purchases unchanged at an annual amount of 80T JPY. The yield curve control policy of targeting the 10-year bond at 0% will likely be unchanged as well. The Bank of Japan has little scope for introducing further stimulus to the economy.

Technical Analysis

EURUSD

Looking at this currency pair, it can be seen to operating bullishly. After reaching the 1.0900 level, the currency pair is now around the 1.0850 level. Closely examining the daily chart of this currency pair, the pair is currently around the 200 day SMA. The answer of which direction the currency pair will move is likely to be answered in the coming days as a result of the French election. With both parties running against one another both would have differing effects on the Euro. With more clarity from the election decision, a position can be opened with this currency pair.