Daily Insights Report 29/06/17

- 29 Jun 2017

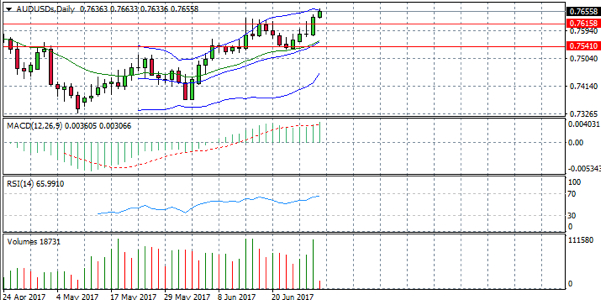

AUD/USD

The AUD/USD has touched/pierced through upper Bollinger band. RSI has also hit the overbought area and flattened indicating the market may reverse or retrace soon. The next price target to confirm the reversal is the 0.761 level. A break of the second Bollinger band is further confirmation. MACD remains negative and trading volume appears to be climbing.

Impact event: U.S. GDP data will be released at 15:30 GMT+3 and will affect all dollar pairs.

GBP/USD

The GBP/USD pair did indeed break the upper trend line to push prices higher in yesterday’s trading session. The move appears to still have some traction as momentum appears to be positive. However, price action is approaching the upper Bollinger band and is reaching close to overbought levels on RSI. MACD is negative with an upward trajectory.

Impact event: U.K. Consumer Credit data will be released at 11:30 GMT+3.

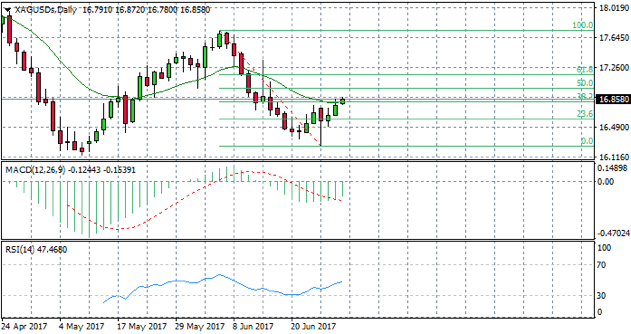

SILVER

Silver appears to have retraced from a significant downtrend over the past month and has broken the 20-day exponential moving average and the 38.2 Fibo level. Momentum appears to still be bullish with RSi having an upward trajectory and MACD becoming less negative. If the pair can break through the 50 Fibo level and reach the 61.8 Fibo level, the probability of a bearish reversal will increase.

USD/CAD

The USD/CAD has entered a sustained downtrend and fell significantly in yesterday’s trading session as oil prices remain volatile. Price action has however, broken lower Bollinger band and RSI has also dipped below the 30 support area. The pair has reached a statistical extreme indicating that there may be exhaustion in market for the current bearish move. Volume has spiked indicating an increase in trading activity for the pair. The next candle to close above the 30 support are on RSI indicates the start of a reversal.