The New Zealand Dollar Begins A Recovery Ahead Of Trade Balance Data

- 23 Nov 2017

EUR/NZD

The EUR/NZD pair has taken a pause in a marked uptrend since July this year. Price action has retraced back to to the 38.2 Fibo level however, a doji candle in yesterday’s trading session indicates that current momentum may not last. A bullish reversal seems likely to resume the previous trend with momentum indicators highlighting strongly bullish sentiment.

Impact event: New Zealand Trade Balance data will be released 23:45 GMT+2 and will impact all NZD pairs.

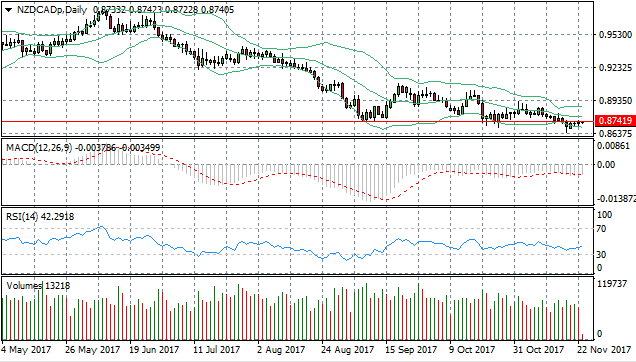

NZD/CAD

The NZD/CAD pair is testing a strong support area at the 0.874 price level which it had previously broken. A break of the lower Bollinger band and a touch of the 30 support level on RSI has sent prices higher. Volume appears to be steady indicating plenty of interest in the pair. Fundamental factors may be required for a breakout to be sustained.

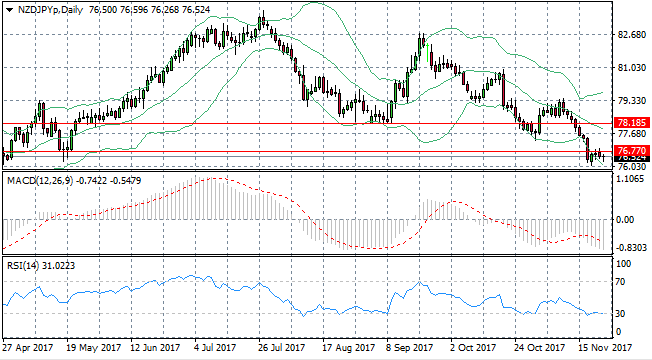

NZD/JPY

The NZD/JPY pair has broken a long-term support area at the 76.77 price level and the lower Bollinger band, with price action beginning what seems like a trend change. Momentum indicators however, are mixed as MACD suggests momentum remains with sellers, yet RSI has hit the 30 support level. Trade Balance data released later in the day may have an impact on the near-term direction of the pair.

GBP/NZD

The GBP/NZD pair appears to be returning from a market high and has broken a recent resistance level at the 1.939 price level. Selling pressure is evident in the last few trading sessions with long upper shadows. RSI is retracing from the overbought 70 line and MACD has declined from previous highs. Given political uncertainty in the U.K., the NZD may be able to make gains on its British counterpart.