The New Zealand Dollar Comes Under Pressure In Early Thursday Trading

- 22 Mar 2018

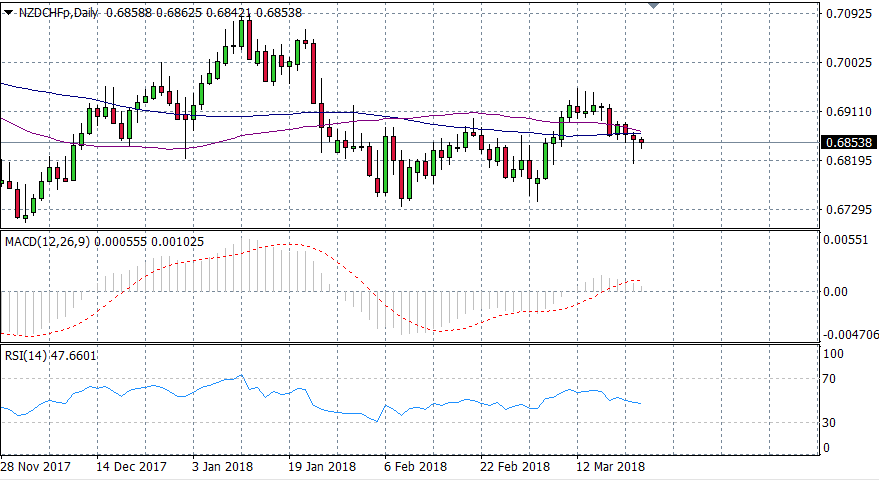

NZD/CHF

The NZD/CHF pair has entered into a longer term downtrend as price action has broken both the 50- day and 100- day moving average. At the same time, a ‘death cross’ seems imminent as the 50- day SMA is on the verge of crossing the 100- day SMA to the downside.

AUD/CAD

The AUD/CAD pair has broken below the 20- period EMA and is now testing the 0.998 price level. A break below the price level would prove significant as it is representative of a previous resistance level. MACD has begun a momentum reversal and RSI has a sharp downward trajectory.

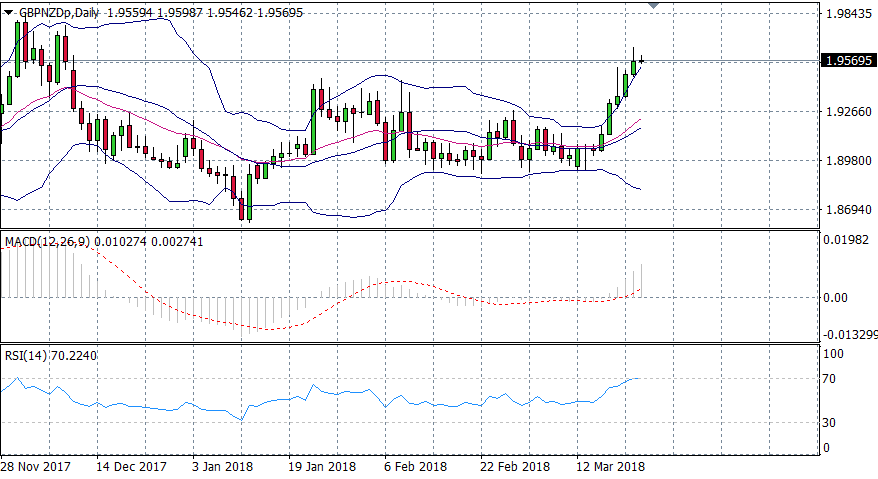

GBP/NZD

The Pound has put the New Zealand Dollar under significant pressure over the last week or so, however, there are signs that the pair is becoming overbought. Consecutive breaks of the upper Bollinger band indicate price action is well above its longer-term average. At the same time, RSI has hit the 70 resistance line. A break below the upper Bollinger band and a momentum reversal on RSI are required to confirm a price reversal.

Impact event: UK Interest Rate and Monetary Policy decisions will be announced at 14:00 GMT+2 and will impact all Dollar pairs.

NZD/CAD

The NZD/CAD pair has broken the 20- period EMA to the downside and is testing the 0.932 price level which represents both a previous support and resistance level. Clearly, a break of this price line is significant and the bearish momentum is also confirmed by a reversal on MACD and the downward trajectory on RSI.