New Zealand Dollar Struggles Against Peers Ahead Of RBNZ Rate Statement

- 8 Nov 2017

EUR/NZD

After a marked uptrend, the EUR/NZD pair appears to be in the middle of a retracement. Price action hit the 61.8 Fibo level in yesterday’s trading session and has bounced back towards the 50 level in today’s trading session. This may mark a bullish reversal as the pair resumes the previous uptrend. RSI has a moderate upward trajectory.

Impact event: RBNZ Rate Statement at 22:00 GMT+2 will likely impact all NZD pairs.

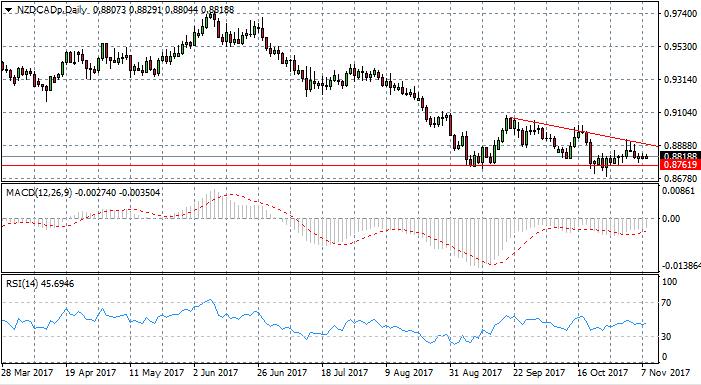

NZD/CAD

The NZD/CAD pair is in the midst of a descending triangle indicating that the current downtrend will likely continue. Lower highs and lower lows characterize the descending triangle with price action heading closer to the 0.876 price level. MACD and RSI confirm the bearish momentum, although both indicators have turned slightly less negative in recent trading sessions. If price action breaks the 0.876 support line, it is a strong signal for sellers.

GBP/NZD

The British pound appears to be extending its dominance over the New Zealand dollar. The pair retraced to the 20-period EMA which is currently acting as a support line and bounced back to resume the uptrend. MACD indicates strong bullish sentiment and RSI indicates that there is still room for further upside.

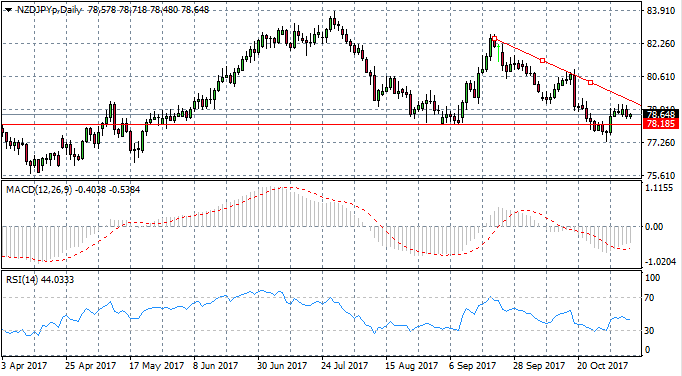

NZD/JPY

The NZD/JPY pair has also entered into a mild descending triangle, characterized by lower lows and lower highs, however price action has broken the lower support line previously. The break resulted in a strong bullish reaction yet the pair is resuming its downtrend. MACD is in strongly negative territory but appears to be turning more positive. RSI has a downward trajectory. Therefore, if price action approaches the 78.18 support line for the second time, a bearish breakout seems likely.