NZ Dollar and Swiss Franc Pairs In The Mix On Tuesday

- 13 Mar 2018

NZD/USD

The NZD/USD pair has broken the high- price SMA to the upside. At the same time, RSI has continued an upward trajectory with further upside potential. MACD has flattened along the zero line.

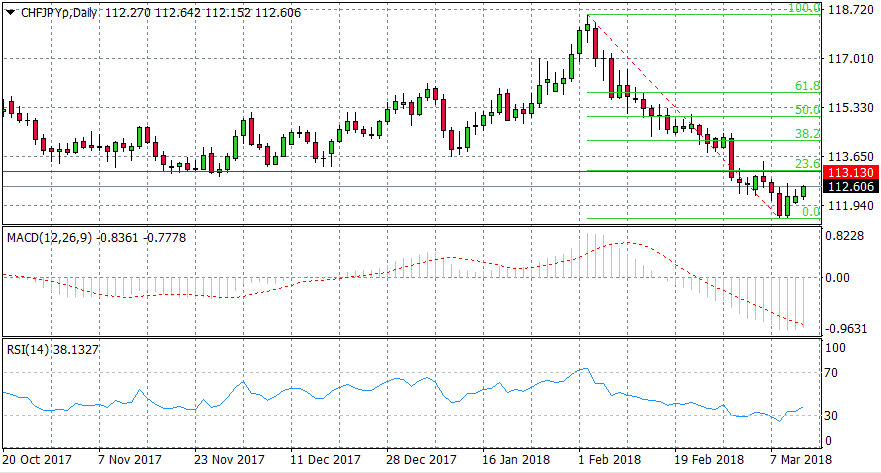

CHF/JPY

The CHF/JPY pair has recovered from a strong sell-off to initiate a bullish reversal. RSI has moved from oversold territory to break the 30 support level. MACD has also started a momentum reversal. A significant resistance area is present at the 23.6 Fibo level which is a 113.13 price target- also representing previous support levels. A break would provide significant weight to the uptrend.

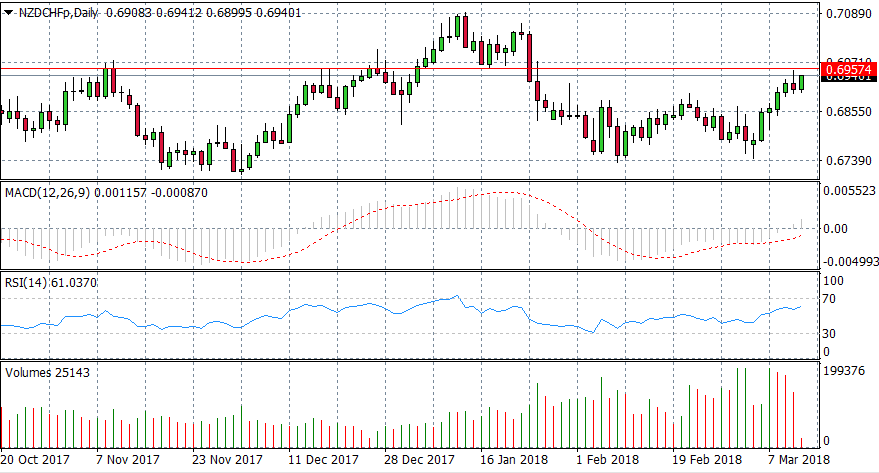

NZD/CHF

The NZD/CHF pair is fast approaching a key resistance level at the 0.697 price line. MACD has broken the zero line as confirmation of bullish sentiment, however, RSI is approaching overbought territory. Volume is also declining which may suggest that buyers lack the conviction to push the pair beyond the 0.697 price level and price reversal may be imminent.

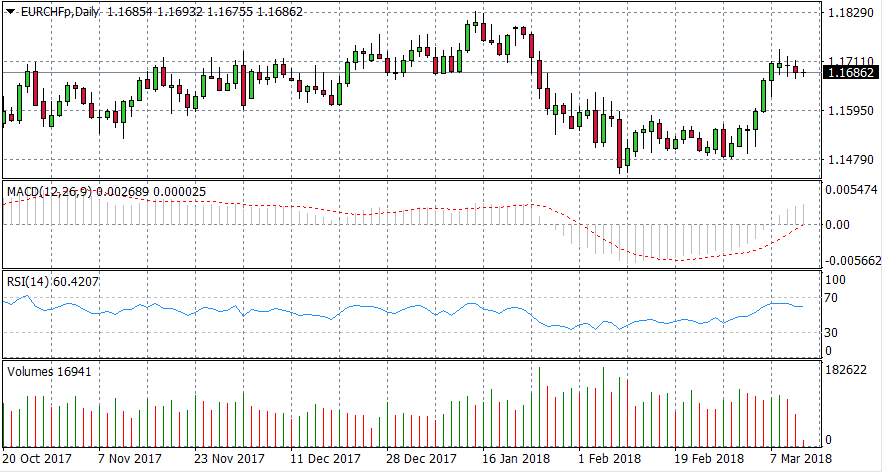

EUR/CHF

The EUR/CHF pair is displaying a bullish continuation pattern known as the ‘cup and handle.’ The cup portion began in mid- January and has now culminated in what looks like the handle as the pair has entered into a slightly downward drift. The fact that volume has tailed off at this point further suggests there may be a breakout imminent as previous buyers initiated selling positions when the pair reached a recent price high around 7th March. The longer term bullish trend will likely continue.