The U.S. Dollar Comes Under Pressure Once Again

- 10 Feb 2021

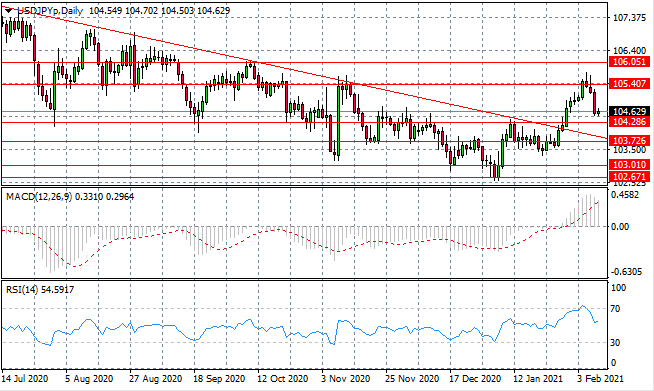

USD/JPY

The USD/JPY pair has pulled back towards the 104.28 support level, as selling activity climbed significantly in yesterday’s trading. Buyers have returned in early trading in a sign that the current trading range will remain intact. Momentum indicators are also undergoing reversals with RSI pulling away from overbought conditions.

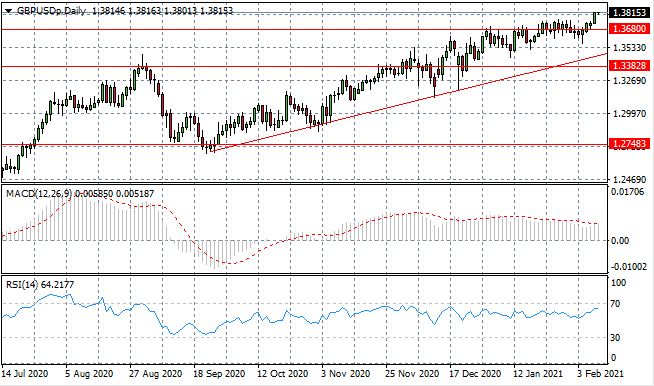

GBP/USD

The GBPUSD rally has found support in mid-week trading as the pair begins to move away from the 1.368 support level. Longer-term, there is a well-established rally and given the positive moves the UK has made with its vaccination program, optimism has returned to the pair. Momentum indicators are bullish with RSI approaching overbought conditions.

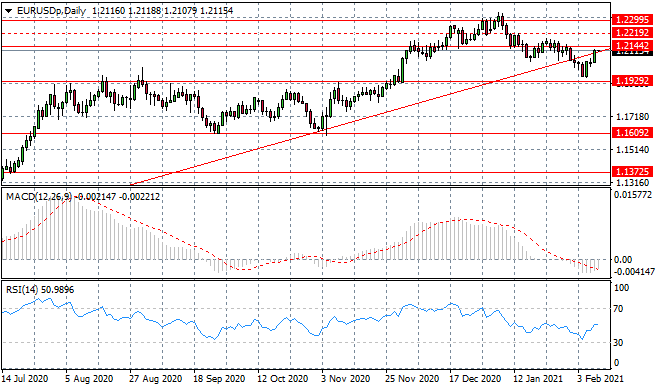

EURUSD

The Eurodollar has moved to test the ascending trendline, as bullish momentum begins to climb, taking price action back towards the 1.214 price level. The pair may consolidate within range at this A consolidative range between the 1.192 and 1.214 price levels will likely represent the upper and lower bound of price action in the near-term. Momentum indicators have flattened in bearish territory.

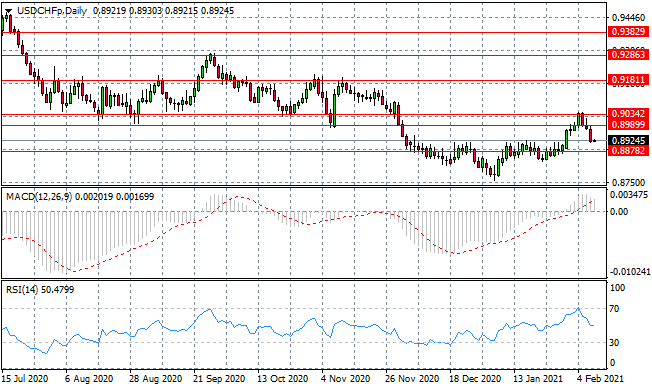

USDCHF

The USDCHF pair has pulled back towards the 0.887 support level, yet the bearish momentum appears to be slowing at the start of trading today. A consolidation range will likely remain between the 0.887 and 0.903 price levels as buyers lacked the conviction to maintain the rally. Momentum indicators have downward trajectories.

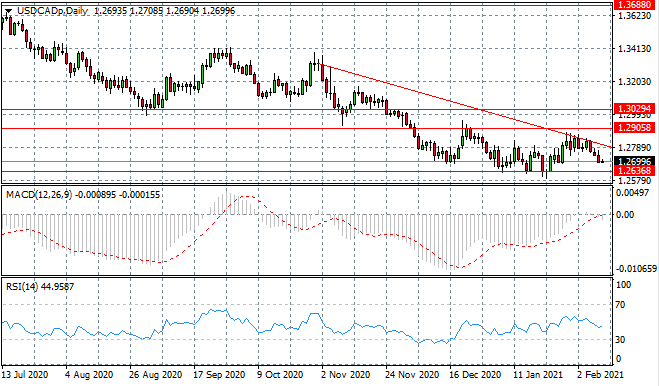

USDCAD

The USDCAD has rejected the upper bound of a descending triangle once again, as the pair returns towards the 1.263 support level. Bearish momentum is moderate (as denoted by the small-bodied candles) indicating that a breakout is not currently on the cards for the pair. Momentum indicators are neutral/bearish territory.

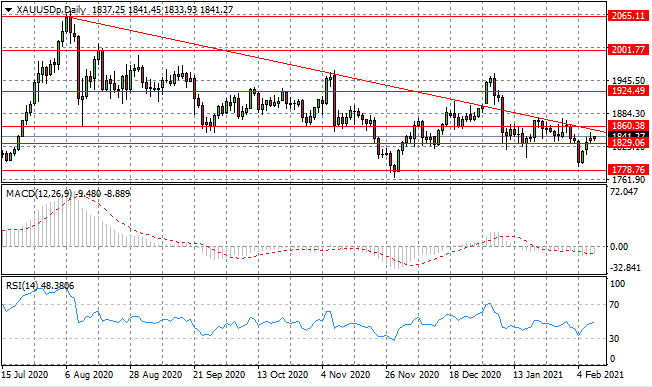

XAUUSD

XAUUSD volatility continues as the metal once again breaks the 1829 resistance line. Price action is headed back towards the descending trendline where on previous occasions, a bearish rebound has occurred. That outcome seems likely to happen again considering the declining bullish momentum. Momentum indicators have begun upward trajectories.

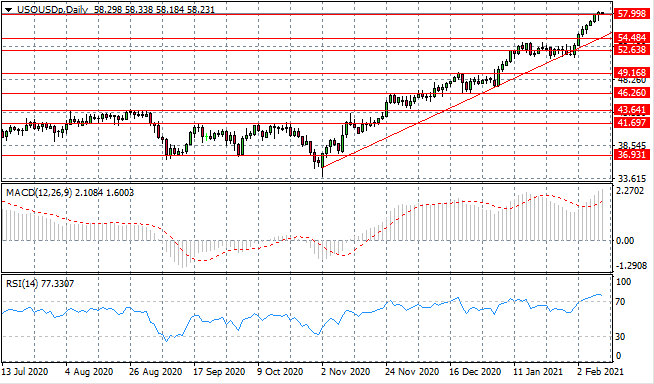

USOUSD

The USOUSD has stalled at a long-term price high at the 57.99 resistance line. A break into the $60 per barrel range would be a psychological breakthrough for the commodity, given the fact that this range is considered a stabilizing price. Momentum indicators are bullish with RSI moving beyond the overbought line.