U.S. Dollar Advances During Asian Trading Session

- 19 Oct 2017

USD/CHF

The USD/CHF pair appears to have hit and rejected a previous market top. After breaking the 0.979 price level, a hanging man candle formation indicates the bullish advance may be coming to an end. The candle indicates that selling pressure has increased and suggests that a bearish reversal is imminent. Additionally, RSI has hit the 70 overbought line and bounced back further confirming a turn in sentiment. A break of the 0.979 price level and a candle closing below the 70 line on RSI will be required to confirm a reversal.

NZD/USD

The NZD/USD pair has broken the 20-period EMA and the is heading towards a recent market bottom at the 0.705 price level. At the same time, RSI is fast approaching the 30 support level indicating there is a chance of a bullish reversal. MACD appears to be slowing suggesting bearish sentiment may be waning. However, the strong bearish candle to start today’s Asian trading session and the moderate rise in volume indicates that sellers still have the appetite to drive prices lower.

GOLD

Gold prices appear to be trading within a fairly tight range between the 1266.85 price level and the 1297.62 price level. However, price action is approaching the 1266.85 price level having broken the 20-period EMA. RSI is also moving towards the 30 support level and MACD is approaching the zero line with upside potential. All signs suggest price action may reverse in the near-term.

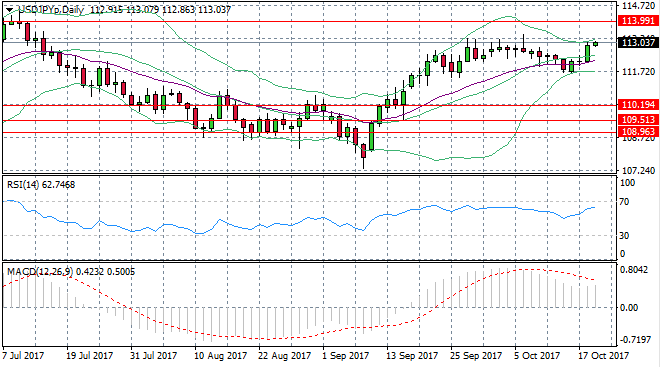

USD/JPY

The USD/JPY pair has advanced beyond the 20-period EMA and is testing the upper Bollinger band. At the same time, RSI is reaching oversold territory confirming that the current bullish move may be short-lived. Further confirmation comes from the sharp downward trajectory on RSI suggesting momentum is with sellers.