The U.S. Dollar Finds Support Ahead Of Powell’s Speech

- 28 Feb 2018

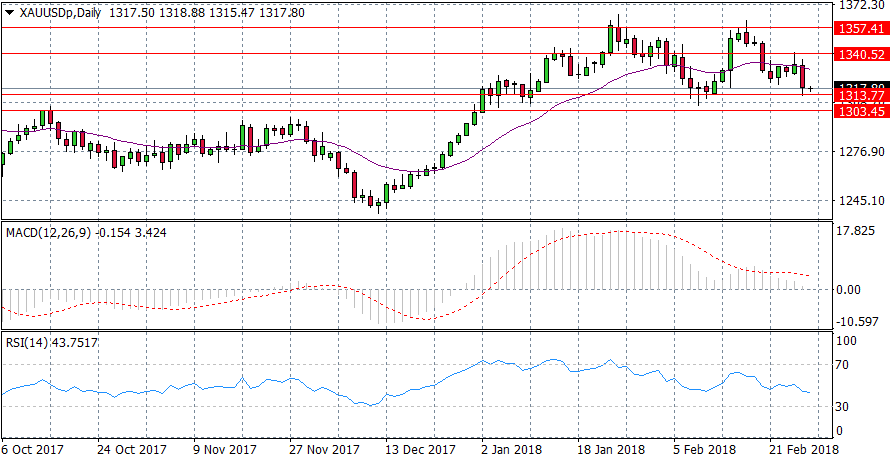

GOLD

Gold has broken the 20-period EMA to the downside and is fast approaching the 1313.77 price level which represents a recent support level. A break of this level would provide weight to the bearish move and send prices towards the 1303.45 price level. Momentum indicators support bearish sentiment with downward trajectories and an imminent break of the zero line on MACD.

Impact event: Federal Reserve Chairman Powell is due to speak at 17:00 GMT+2 and U.S. Prelim GDP data will be released at 15:30, which will likely impact all USD pairs as well as Gold.

SILVER

A visible descending triangle on the Silver chart confirms that the current bearish sentiment will likely continue. A break out to the downside of the triangle seems imminent as the pair move close to the apex. MACD and RSI confirm bearish sentiment.

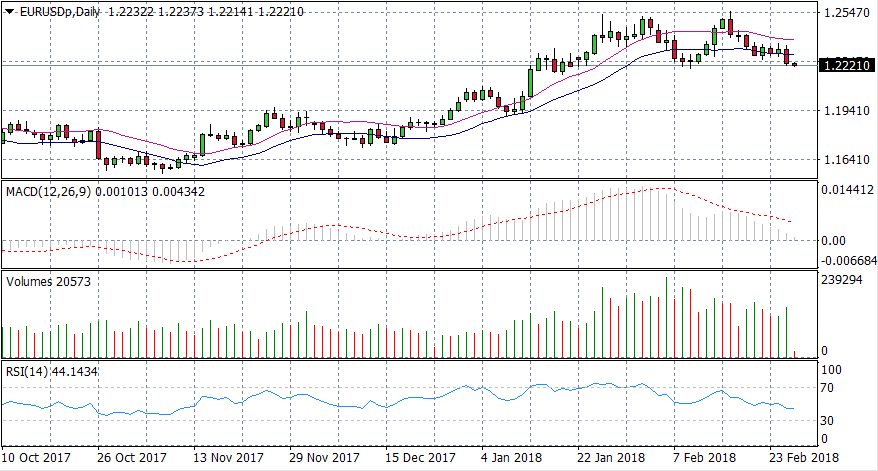

EUR/USD

A break of the low price SMA to the downside cements bearish sentiment for the EUR/USD pair. MACD is fast approaching the zero line and RSI has a downward trajectory. The break came with a spike in volume indicating strong conviction from sellers.

USD/CHF

The USD/CHF pair is testing the 0.941 price level at the same time as breaking the 20-period EMA to the upside. Momentum indicators have positive trajectories and volume has been rising into the bullish advance.