US Dollar Still In The Fight

- 12 May 2021

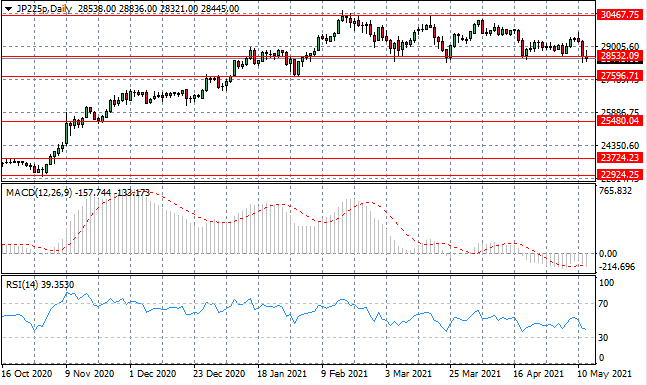

USD/JPY

The USDJPY has fallen back below the 109.09 resistance area, as a series of small-bodied candles indicate waning bullish momentum. Price action is moving back towards the ascending trendline which remains a key support level where buyers typically return. Momentum indicators are bullish, with MACD testing the zero line.

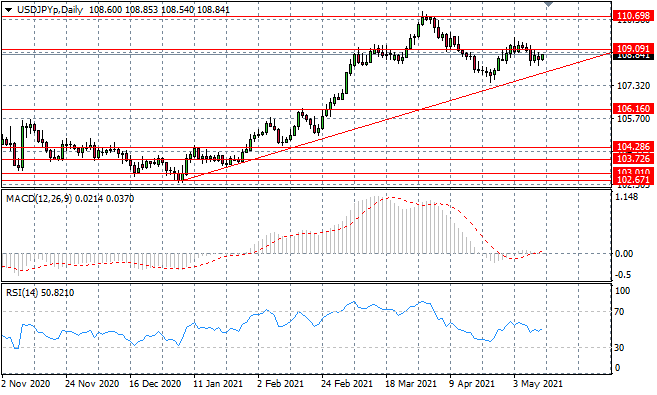

GBP/USD

The GBPUSD pair is testing a recent price ceiling at the 1.413 resistance level, where price action has stalled. In the past, the pair has reverted from this level and price action has faded in a moderately bearish direction. Momentum indicators are bullish with RSI angling away from the overbought line.

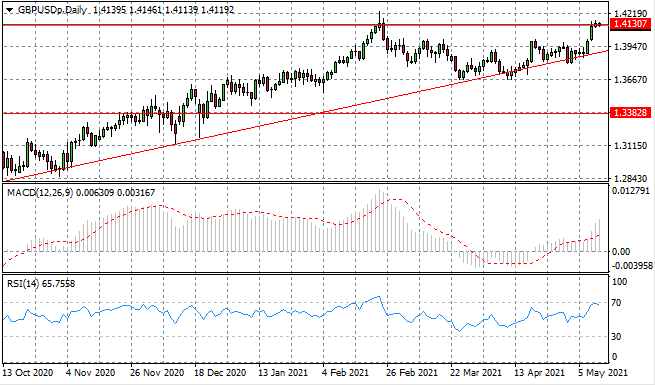

EURUSD

The Eurodollar has failed to break the 1.217 resistance level, as a bullish momentum has begun to weaken. The resistance area has been a significant obstacle on several occasions in the past. Momentum indicators have stalled in bullish territory, yet there is further upside potential.

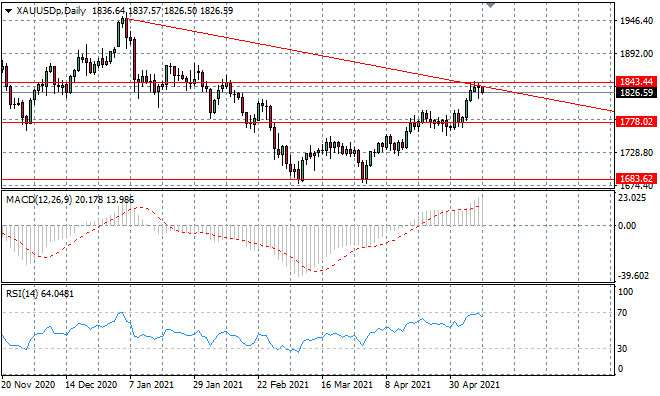

XAUUSD

XAUUSD has failed to clear the 1843 price area which is forming a significant resistance area for the metal. Despite buying pressure in yesterday’s trading, momentum was insufficient to drive the break. Momentum indicators are bullish with RSI testing overbought conditions.

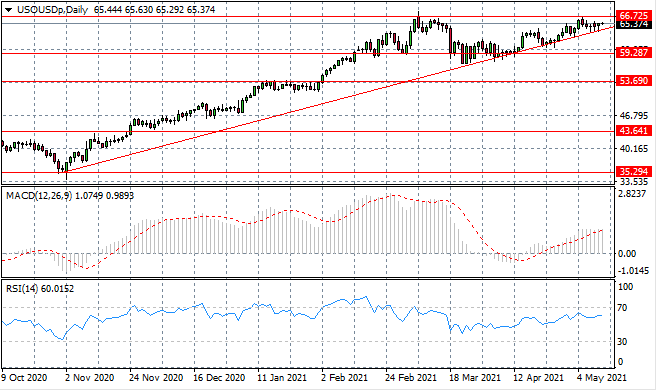

USOUSD

USOUSD is maintaining its bullish outlook as the ascending trendline remains a key support level, with price action tracing the trendline upwards. A key target is the 66.75 price line which, so far, has successfully contained price action. Momentum indicators remain in bullish territory, though have flattened.

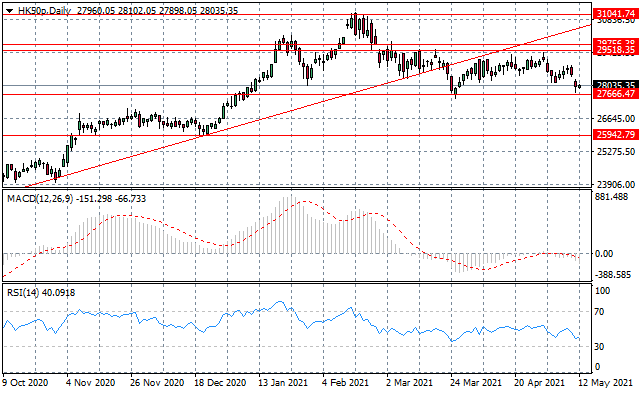

HK50

The HK50 has moved lower to test the 27,666 support line once again. Price action has been contained in the 27,666- 29,518 range since February, so significant bearish sentiment will be required to facilitate the break. Momentum indicators are bearish.

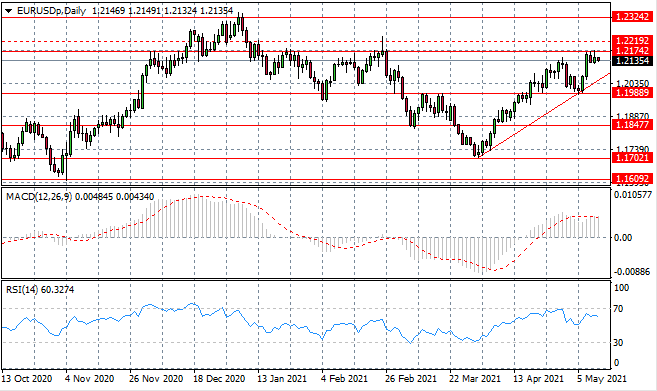

JP225

The JP225 index has repeatedly tested the 28,532 support level and with the rising bearish momentum, a break may be imminent. Lower highs represent a shift towards a downtrend, after many months of consolidation. Momentum indicators are bearish.