USD/CAD Volatility Continues

- 22 Nov 2018

USD/JPY

The recent pullback for the USD/JPY pair appears to have been short-lived. Price action has returned to break the 112.82 price level. Momentum indicators reflect the pullback in price action; with MACD approaching the zero line to the downside and RSI remaining in bearish territory, however, the trajectory has turned more bullish.

EUR/USD

The EUR/USD pair suffered another mild sell-off in yesterday’s trading before the pair was able to reach the next key support level at 1.153. The pair is now heading back towards the descending trendline and a break may signal the end of the recent rally. A momentum reversal continues on MACD, however, RSI appears to have turned more bearish.

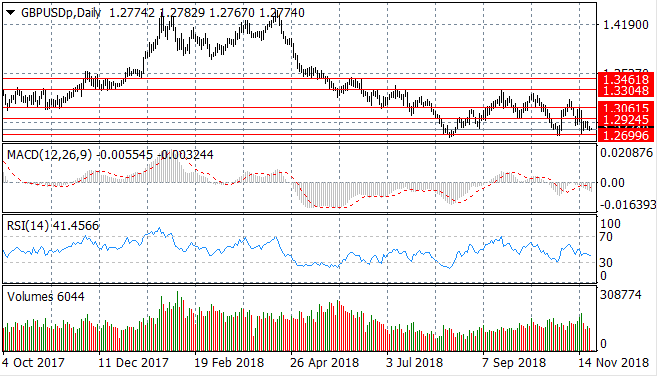

GBP/USD

Fundamental factors influenced the recent sell-off in the GBP/USD pair and these factors continue to put pressure on the Pound. Buyers appear to have been stymied as price action failed to break the 1.292 price level. Momentum indicators have a bearish bias, with MACD extending beyond the zero line and RSI is heading back towards the 30 support level.

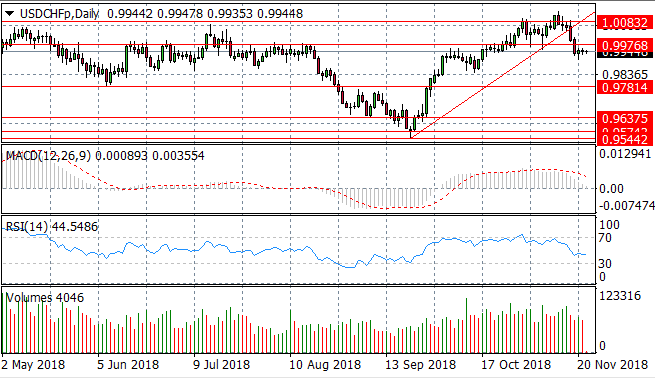

USD/CHF

The USD/CHF pair has broken the 0.997 price level to the downside which appears to have inspired buyers to return to the pair. A series of doji candles indicates indecision as neither buyers nor sellers have the conviction to drive price action. Momentum indicators are bearish with MACD approaching the zero line and RSI approaching the 30 support level.

USD/CAD

The USD/CAD seemed indeed to be overbought which inspired sellers to push the pair back below the 1.326 price level. The pair is once again approaching the ascending trendline and the next target is therefore the 1.320 price level. Momentum indicators are also turning less bullish with RSI pulling back from the 70 resistance level and MACD decelerating in bullish territory.

SILVER

Silver has rebounded from the 14.03 price level to maintain a recent trading range between the 14.03 and 14.91 price levels. The metal is now testing the 14.41 price level. A series of doji candles indicate neither buyers or sellers are dominating the commodity therefore it will likely consolidate within range.

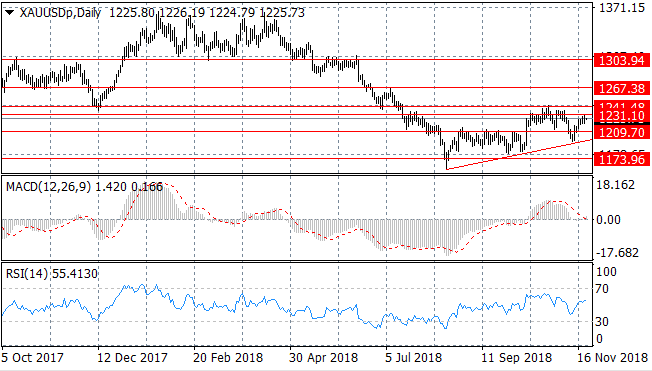

GOLD

Gold has once again undergone a bullish retracement from the ascending trendline at the 1191.58 price level and as a result, is heading towards the 1231.10 price level. Momentum indicators are mixed with MACD touching the zero line and RSI pulling breaking the 50 default line.

OIL

Oil had been attempting a recovery from the large scale sell-off, however, sellers returned to push WTI further towards the $50/barrel range. Momentum indicators suggest that support for the bearish bias has cooled; with MACD stalling in bearish territory and RSI heading back towards the 30 support level.