Canadian Dollar Weaknesses Continues

- 27 Sep 2018

How can you diversify your trading with indices? Join Lauren on 28Sept to learn more now.

USD/JPY

The USD/JPY pair has continued the bullish run and is fast approaching the 113.26 price level. However, price action appears to have stalled just beneath the market top. Momentum indicators remain bullish although RSI is pulling away from overbought conditions.

Impact event: U.S. GDP data will be released at 12:30 and will impact all USD pairs.

EUR/USD

The EUR/USD pair has rejected the 1.179 price level and has fallen back to break the 1.173 price level. At the same time, RSI has pulled away from overbought conditions and MACD is beginning a momentum reversal.

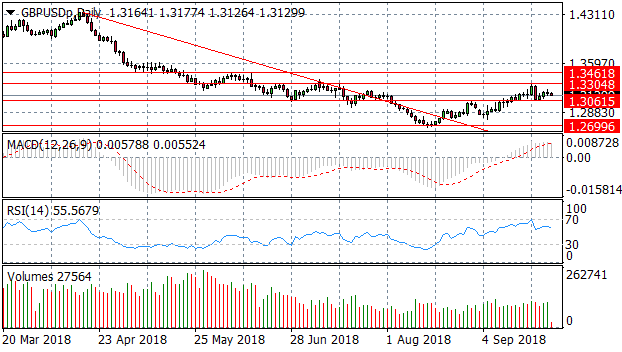

GBP/USD

The GBP/USD pair is consolidating just above the 1.306 price level after a strongly bearish move in recent trading. Momentum indicators are neutral if slightly bearish.

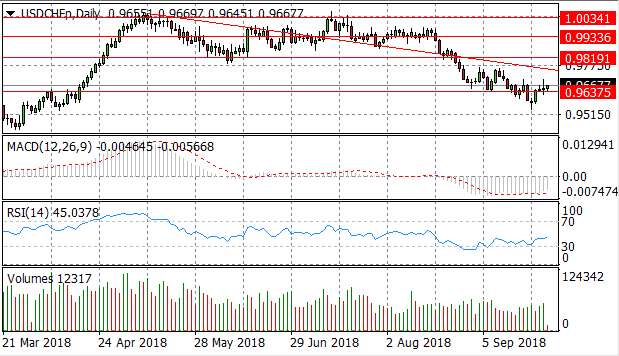

USD/CHF

The USD/CHF pair has broken the 0.963 price level to the upside this time in an apparent shift in sentiment. The evening star doji pattern has resulted in a break of the key support level.

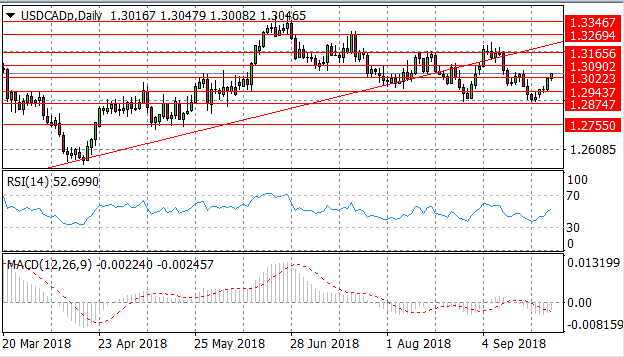

USD/CAD

The USD/CAD pair appears to be heading towards the 1.309 price level after several breaks of key support areas. Momentum indicators have turned sharply bullish.

SILVER

Silver’s break of the descending trendline could prove significant given the strong bearish bias the metal has been experiencing since June. Additionally, Silver is testing the 14.46 price level which represents a key long-term support level. MACD is undergoing a bullish momentum reversal.

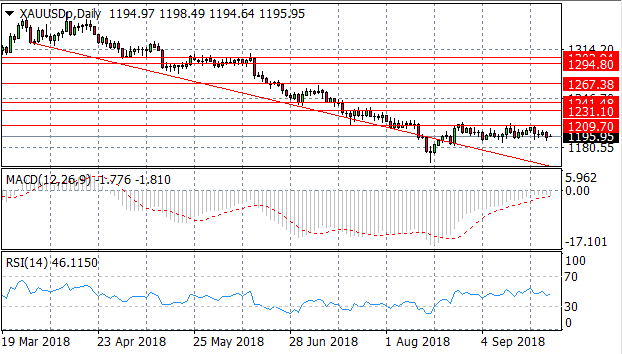

GOLD

Price action continues to consolidate just below the 1209.70 support level. Despite an attempt to test the support level, price action remains in consolidation. Momentum indicators are mixed; with MACD approaching the zero line and RSI in neutral territory.

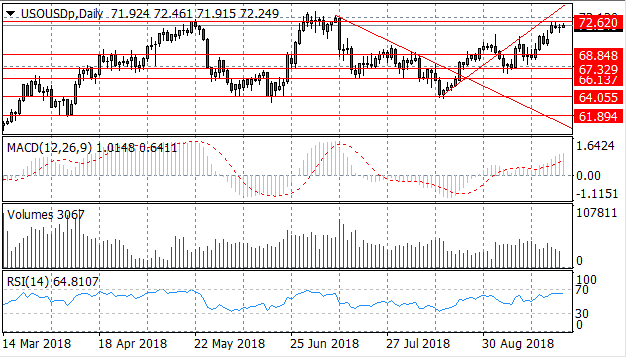

OIL

Oil price volatility continues as the commodity has made strides towards a recent market top at the 72.62 price level. However, the commodity has fallen short of the resistance area, which may signify a lack of conviction from buyers to drive prices higher. Momentum indicators are bullish however, RSI has reached overbought conditions.