GBP Bullish Ahead Of GDP Data

- 10 Oct 2018

USD/JPY

The USD/JPY pair has broken the 113.20 price level in a strong bearish move. At the same time, momentum indicators have reversed a previous bullish position; with RSI pulling back from the 70 resistance level.

EUR/USD

The EUR/USD pair has broken the 1.153 price level, yet appears to have stalled just below the price level. Momentum indicators are bearish; with MACD crossing the zero line and RSI bouncing along the 30 support level.

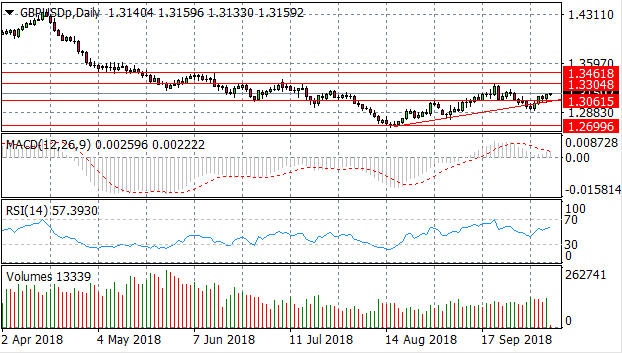

GBP/USD

The GBP/USD pair has broken the 1.306 price level as well as the ascending trendline. Momentum indicators are moderately bullish; RSI has reversed a previous bearish trajectory and MACD is pulling away from the zero line.

Impact event: GBP GDP data is due to be released at 08:30 GMT and will impact all GBP pairs.

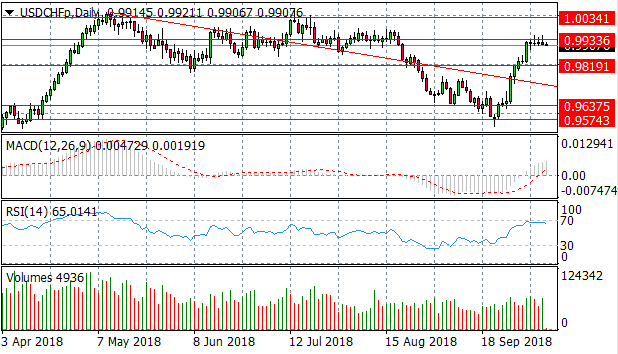

USD/CHF

The USD/CHF pair has broken the 0.981 price level and is now testing the 0.993 price level. Momentum indicators are bullish with MACD breaking the zero line to the upside. RSI has flattened at the overbought area.

USD/CAD

The USD/CAD is undergoing a bullish reversal but continues to test the 1.294 price level. RSI has reversed its position from oversold conditions and MACD appears to be undergoing a momentum reversal.

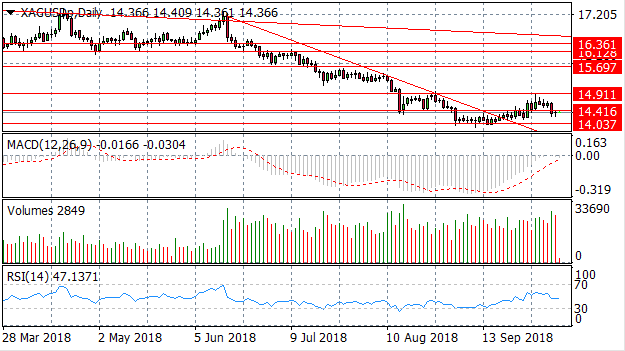

SILVER

Silver has retraced back towards the 14.41 price level after the recent bullish move failed to gain traction. MACD appears to be on the verge of a break of the zero line. RSI has flattened in neutral/bearish territory.

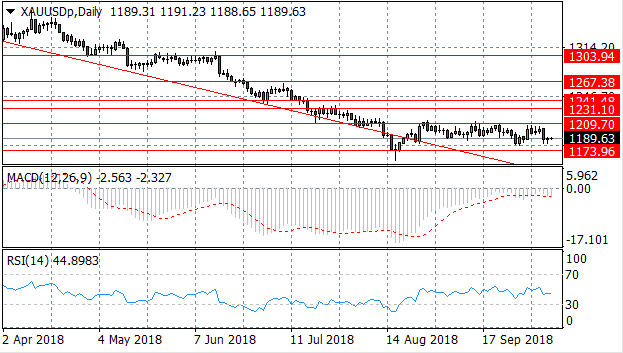

GOLD

The 1209.70 price level has developed as a strong resistance area for Gold in recent trading, with each attempt to break the price level being rejected. The pair will likely trade in range between the 1173.96 and the 1209.70 price levels. Momentum indicators are neutral with MACD falling just short of the zero line.

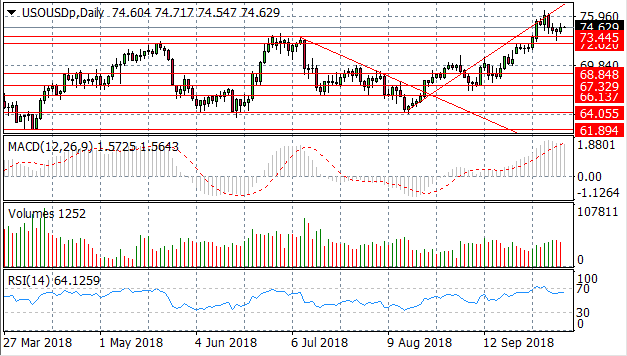

OIL

Oil price has rejected the ascending trendline, falling back to test the 73.44 support level. Momentum indicators are also reversing, MACD has become less positive and RSI has pulled back from overbought conditions.