Euro Buyers Stopped In Their Tracks

- 3 Sep 2020

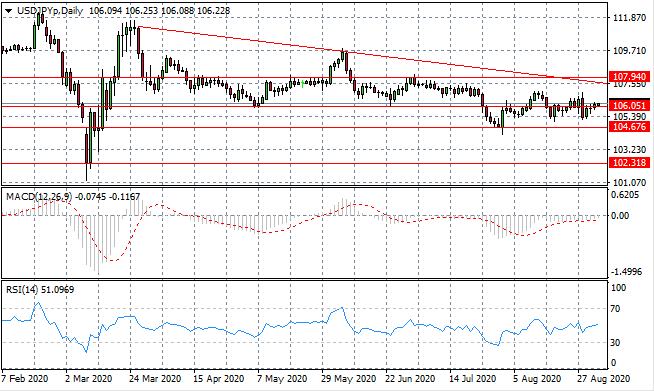

USD/JPY

The USD/JPY pair continues to test the 106.05 price level, with a moderate break underway. Bullish momentum continues to be weak yet there is an absence of selling activity. Neither currency seems to have the favour of buyers. Momentum indicators have stalled in neutral territory.

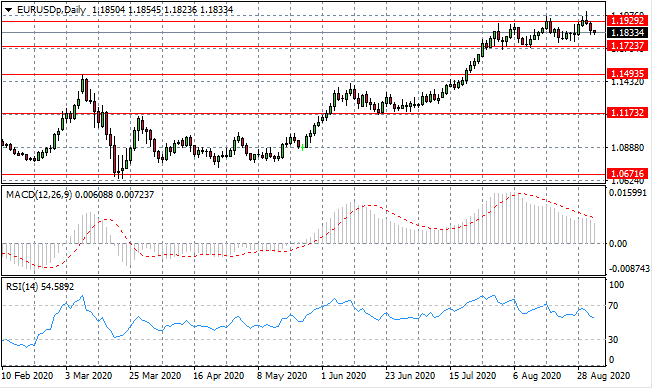

EUR/USD

The Eurodollar has pulled back once again from the 1.192 price high, as sellers have returned. The 1.172-1.192 range will likely remain intact in the near-term as bullish momentum appears to be waning. A long-term rally remains. Momentum indicators reflect the switch to bearish sentiment.

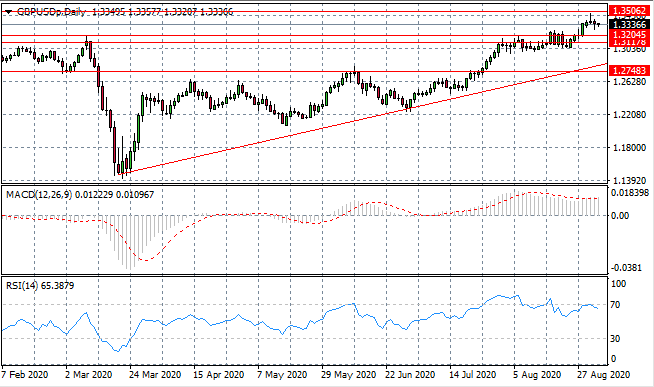

GBP/USD

The GBP/USD pair has stalled before reaching the 1.350 resistance level and a series of small-bodied candles represent indecision as the pair hangs in mid-range. The long-term rally remains intact so far, indicating the current move could be a retracement. Momentum indicators are bullish yet RSI is pulling away from overbought conditions.

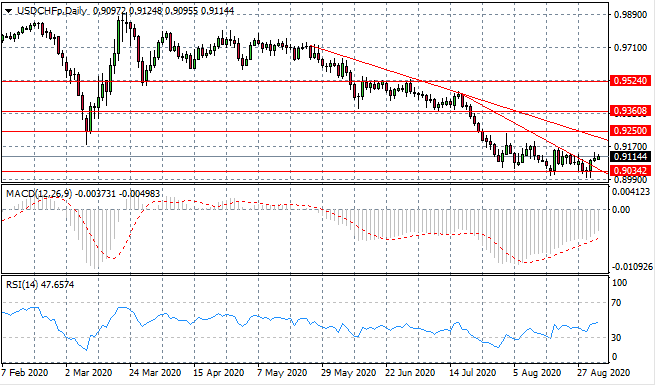

USD/CHF

The USD/CHF reversal is struggling to find support mid-rally indicating that the move may lose steam. The pair may continue the horizontal move that has been a pattern in recent price action, however, given the significance of the longer-term bearish trend, we may expect further downside for the pair. Momentum indicators have upward trajectories.

USD/CAD

The USD/CAD has stalled at the 1.302 support level. There is low volatility in the pair in reflection of the lack of action in oil markets. Dollar weakness has driven he majority of the moves in the pair in recent weeks. A change in economic conditions will be required to drive price action. Momentum indicators are bearish, with RSI testing oversold conditions.

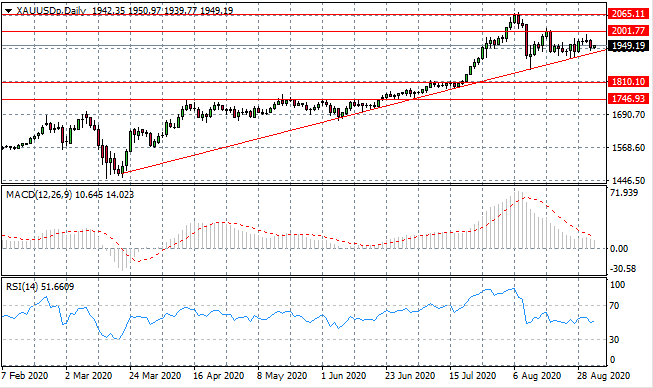

GOLD

Gold buyers have given way to sellers which has once again taken the metal back to the ascending trendline. In early trading a bullish rebound appears to be forming, as has been the case on several previous occasions. Oscillations are narrowing into the apex of the triangle, indicating a breakout is imminent. Momentum indicators have flattened in bullish/neutral territory.

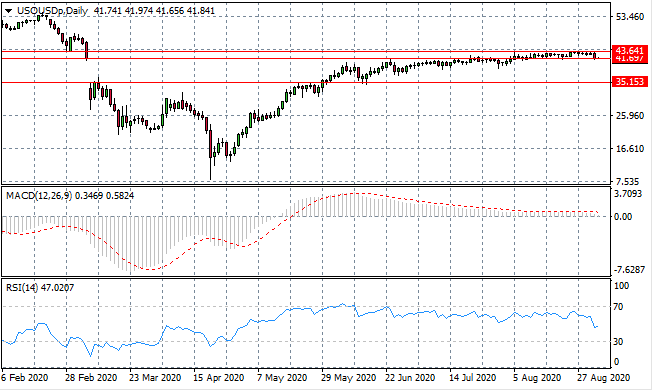

OIL

The WTI rally appears to have ignited the interest of sellers which has resulted in price action pulling back to the 41.69 support level. The commodity will likely continue in this range in the near-term. Momentum indicators are mixed; with MACD flat in bullish territory and RSI beginning a sharp downward trajectory.