XAUUSD Sell-Off Continues

- 2 Mar 2021

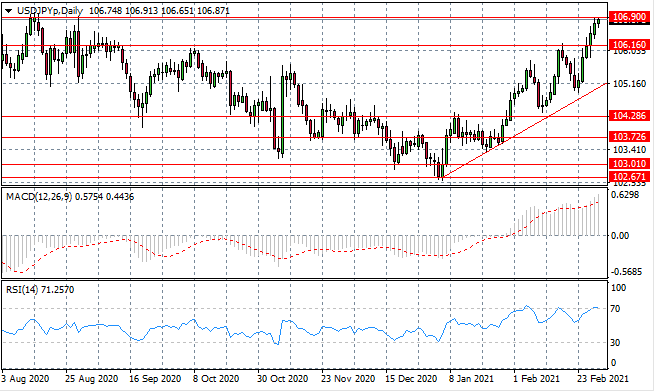

USD/JPY

The USD/JPY pair continues to touch a recent price high at the 106.05 price level, which has proven to be an obstacle in the past. A break seems inevitable given the pace of the rally and there still appears to be significant buying activity. Momentum indicators remain bullish with RSI testing the 70 overbought line.

GBP/USD

The GBPUSD rally has pulled back yet there seems to be indecision, with an incomplete reversal. A doji in yesterday’s trading highlights a halt in bearish momentum. Momentum indicators appeared to be undergoing reversals yet remain in bullish territory.

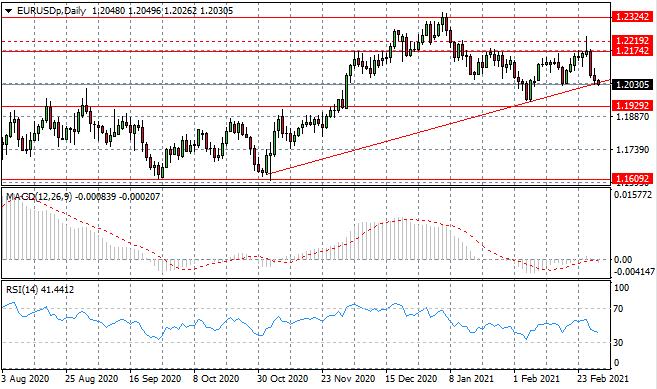

EURUSD

The Eurodollar has once again pulled back to the ascending trendline as strong bearish momentum begins to dominate price action. The trendline has acted as a support level since the end of October and significant bearish momentum will be required for a break. Momentum indicators remain in bearish territory.

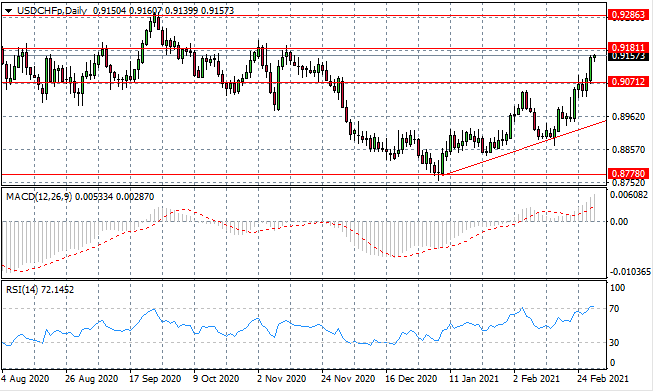

USDCHF

The USDCHF pair has begun to climb towards the 0.918 resistance line which was the top of a previous trading range in the past. A break would indicate a return towards pre-pandemic levels. Momentum indicators have sharp upwards trajectories, yet RSI is testing the overbought line.

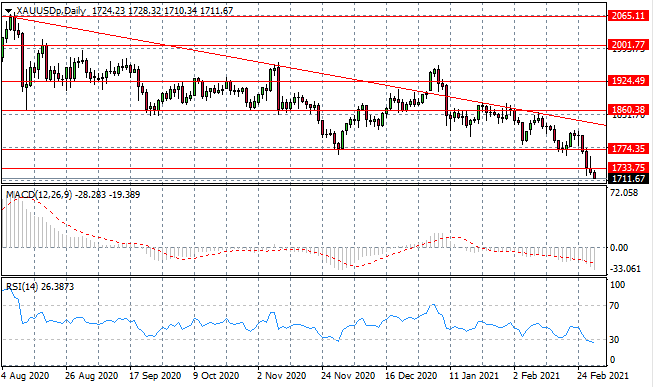

XAUUSD

XAUUSD reversed early gains in yesterday’s trading to not only return to the 1733 support area, but sellers also drove a break of the long-term support line. Momentum indicators are bearish with RSI moving beyond the oversold line.

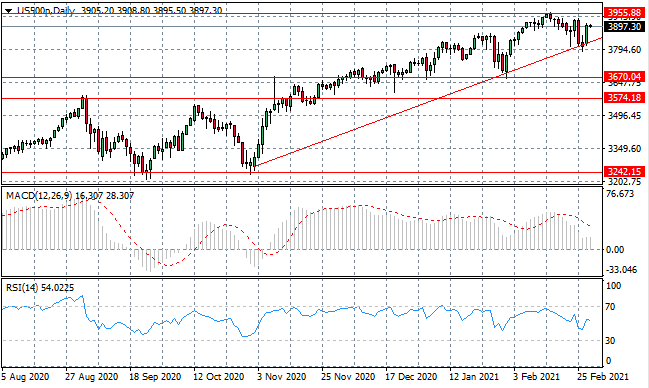

US500

The US500 has rebounded from the ascending trendline once again, as buyers returned to take price action back towards the 3955 resistance line. The index is moving towards the apex of an ascending triangle where a bullish breakout can be anticipated. Momentum indicators remain in bullish territory.