Canadian Dollar Weakens Ahead Of CPI Data

- 19 Oct 2018

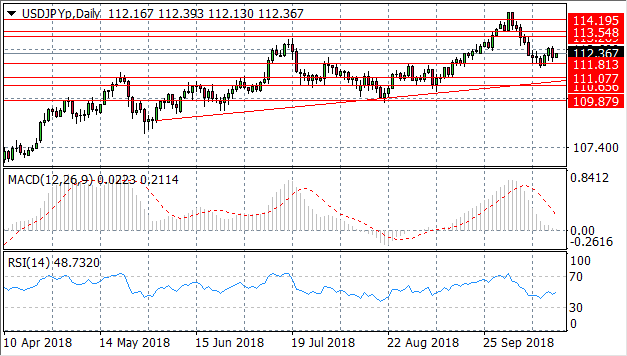

USD/JPY

The USD/JPY pair has bounced back from the 111.81 support line, as price action appears to be turning bullish. Momentum indicators are mixed; MACD looks close to breaking the zero line to the downside whilst RSI has reversed a previous bearish move.

EUR/USD

The EUR/USD pair has broken the 1.153 price level and the bearish momentum looks set to continue. The next price target for sellers is the 1.133 price level. MACD remains bullish whilst RSI is approaching the oversold 30 support level.

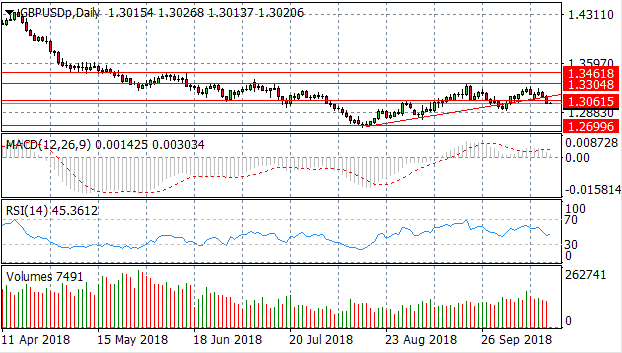

GBP/USD

The GBP/USD pair is once again approaching the ascending trendline around the 1.306 price level. Each time the pair has reached the price area it has bounced back into a bullish direction. However, this time price action has breached the trendline and momentum indicators are bearish in support of the move.

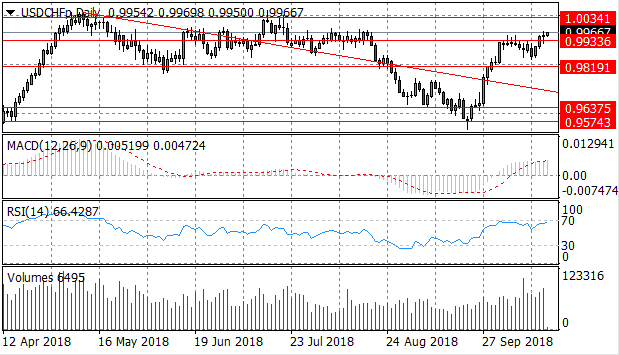

USD/CHF

The USD/CHF pair has broken the 0.993 price level in a strong bullish move, with price action continuing the break towards the 1.003 price level. Momentum indicators suggest that the bullish move may not last, as RSI has hit overbought conditions and MACD stalls in slightly bullish territory.

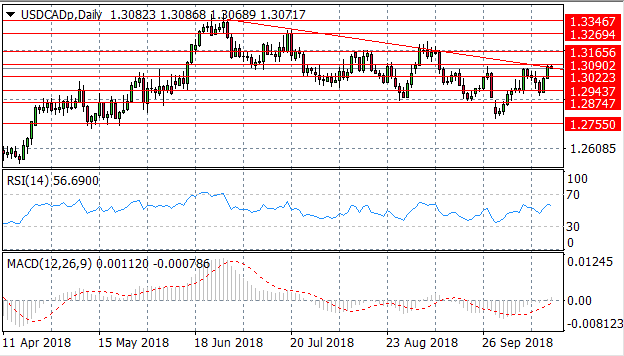

USD/CAD

The USD/CAD has broken the 1.302 support level and is testing both the descending trendline and the 1.309 price level. RSI has a moderate bullish trajectory and MACD is close to breaking the zero line.

Impact event: Canada Retail Sales and CPI data will be released at 12:30 GMT and will impact all CAD pairs.

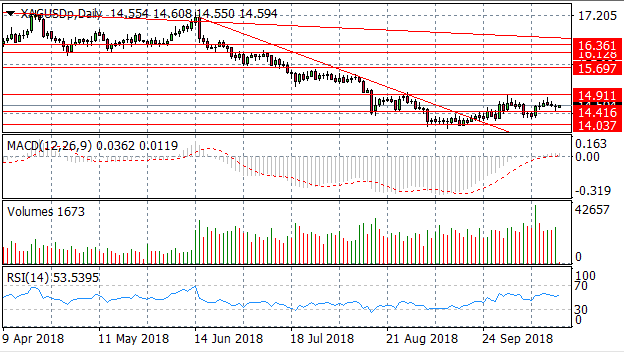

SILVER

Silver has broken the 14.41 price level yet the move once again seems to have stalled after the break. The next target for buyers is the 14.91 price level. MACD has just broken the zero line and RSI is moderately bullish.

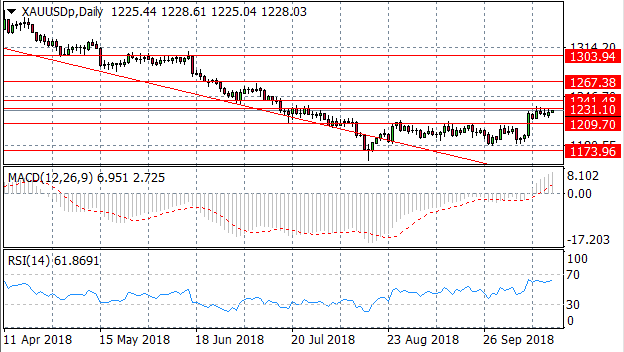

GOLD

Gold has managed to break the 1209.70 price level, and has now moved to test the 1231.10 price level. However, a series of doji candles may indicate that the previous bullish move has lost steam. Momentum indicators have turned sharply bullish; with MACD breaking the zero line to the upside and RSI stalling just below overbought conditions.

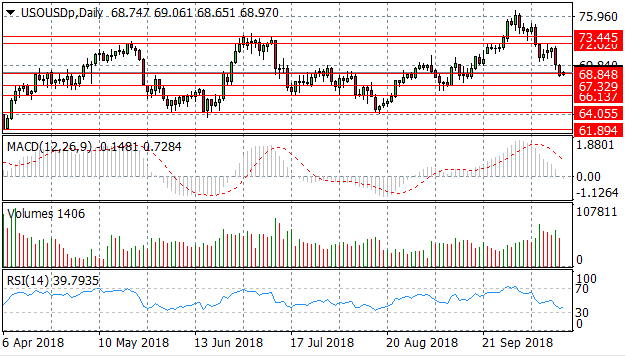

OIL

Oil price has rejected the ascending trendline, falling back to break both the 73.44 and 72.02 support levels. The commodity is now testing the 68.84 price level. Momentum indicators are also reversing, MACD is on the verge of breaking the zero line and RSI is coming close to oversold conditions.