Daily Insights Report 20/06/17

- 21 Jun 2017

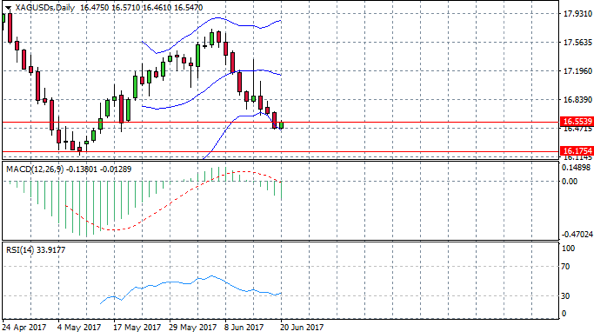

SILVER

Silver appears to be heading into oversold conditions. A break of the lower Bollinger band has resulted in a bullish move in the current trading session. RSI has also bounced off of the ‘30’ support area. Price action is testing a previous support area at 16.55 and if it breaks this area, momentum will likely drive Silver prices higher.

USD/CHF

A break of the 20-day exponential moving average (EMA) could signify the beginning of an upward trend for the USD/CHF pair. The moving average is providing support for price action. If the pair can break through a previous resistance of 0.976, bullish momentum will likely continue. MACD has an upward trajectory and is moving towards positive territory. RSI remains neutral.

Impact event: SNB Chairman Jordan speaks at 11:45 GMT+3, followed by the Fed’s Stanley Fischer speech at 15:00 GMT+3.

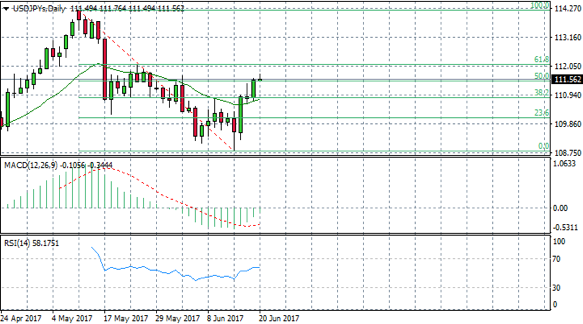

USD/JPY

After breaking the 20-day EMA, the USD/JPY pair has continued on its upward trajectory. The pair has found resistance at the 50 Fibo level, yet momentum indicators suggest that sentiment is becoming less negative. It appears that the upward trend may not be sustained beyond the 61.8 Fibo level as RSI suggests the pair is heading into overbought conditions. If the pair manages to reach the 61.8 level, there is a chance of a bearish reversal.

NZD/USD

According to the 4-hour chart the New Zealand Dollar will continue its dominance over the U.S. Dollar. Price action bounced off the 50-day moving average and turned more bullish, indicating near-term momentum in the pair is bullish. Both 50-day and 100-day moving averages have an upward trajectory. RSI has turned sharply positive and MACD remains above the zero line as confirmation of the uptrend.

Impact event: Global Dairy Trade Auction result, time is unconfirmed.