The Canadian Dollar Is Subdued Ahead Of Rate Decision

- 17 Jan 2018

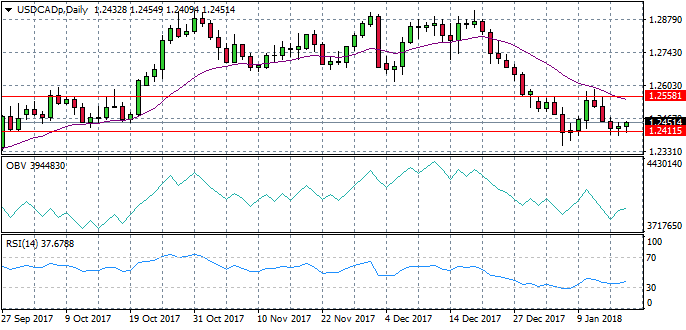

USD/CAD

The USD/CAD has hit a market low representing a recent support line for the pair. A doji candle after reaching the support area represents indecision from market participants. Consecutive bullish candles could signal the beginning of a reversal. At the same time, RSI has recovered from the 30 support level and has an upward trajectory, which is also confirmed by the trajectory of volume as buyers appear to be active in the pair.

Impact event: Bank Of Canada Interest Rate Decision at 17:00 GMT+2 will impact all CAD pairs.

GBP/CAD

After a break of both the 20-period EMA and the 1.710 price level, the GBP/CAD pair appears to have stalled. A series of doji candles indicate that the bullish run may be coming to an end. RSI has stalled just below overbought territory yet, MACD signals momentum is bullish. The next price target for bulls would be the 1.722 price line, however, fundamental factors later in the day may impact the near-term direction for the pair.

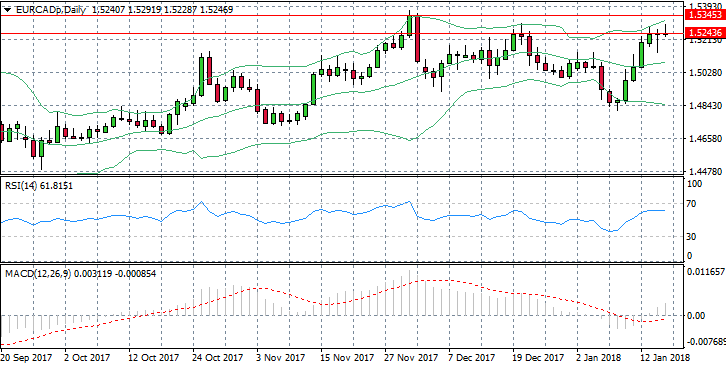

EUR/CAD

The EUR/CAD pair is testing the 1.524 resistance line which represents a fairly strong resistance level for the pair. The strong bullish move appears to have lost steam with today’s session indicating a rise in selling pressure and RSI flattening in bullish territory. MACD indicates momentum remains bullish with an imminent break of the zero line. The next price target for buyers will likely be the 1.534 price line which represents a recent market top.

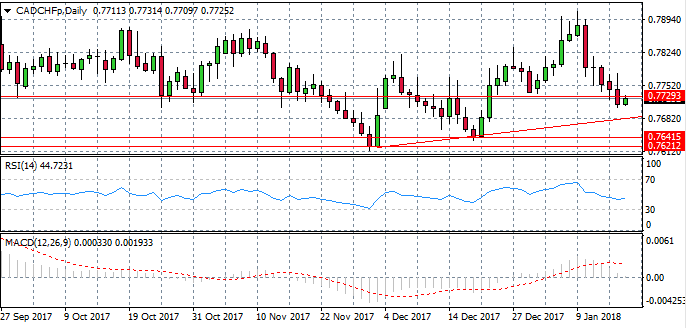

CAD/CHF

The CAD/CHF pair has broken below the 0.772 support line despite the pair seeming to form a longer-term uptrend. Each time this support level has been reached in recent months, the pair has retraced in a bullish direction, which is confirmed by the bullish candle in today’s trading session. Momentum indicators confirm bullish sentiment.