Dollar Weakness Persists

- 18 Jan 2018

GBP/USD

The GBP/USD pair has reached overbought conditions as the Pound has enjoyed a sustained rally. However, there are signs that selling pressure has increased and with RSI flattening above the 70 line, price action may retrace in the near-term. Consecutive breaks of the upper Bollinger band further indicate that the Pound has appreciated significantly against the U.S. Dollar, further than recent averages. Additionally, fundamental factors may play a role later on in the day.

Impact event: U.S. Housing market data will be released at 15:30 GMT+2 and will impact all Dollar pairs.

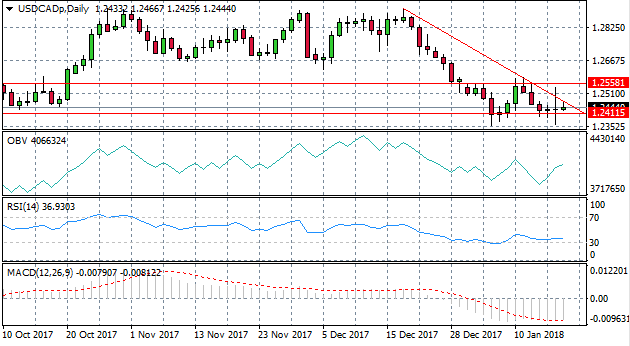

USD/CAD

The USD/CAD pair has been in a downtrend since mid-December and appears to be approaching the upper trend line. Price action pierced the trend line in yesterday’s trading, however, the session ended with a doji highlighting indecision from market participants. Momentum indicators confirm bearish sentiment but do not provide any clarity regarding near-term momentum. The pair will likely trade between the 1.241- 1.255 price levels.

GOLD

Gold has thrived off the back of U.S. Dollar weakness yet has retraced a few times during the recent bull run. A strong bearish candle in yesterday’s session has resulted in the pair approaching the 23.6 Fibo level. Both RSI and volume indicate that momentum is bullish and that the previous uptrend may resume in the near-term.

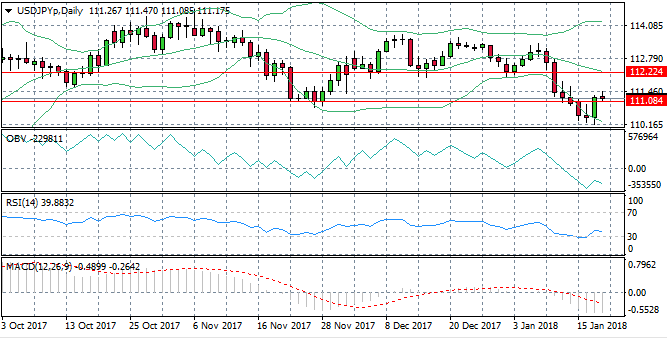

USD/JPY

The USD/JPY pair has reversed a previous downtrend and recent market bottom. Yesterday’s session saw the pair break the 111.08 price level. Momentum indicators suggest that momentum is still bearish and volume is declining, indicating that the buyers may not have the conviction to drive prices higher.