Daily Insights Report 02/08/2017

- 2 Aug 2017

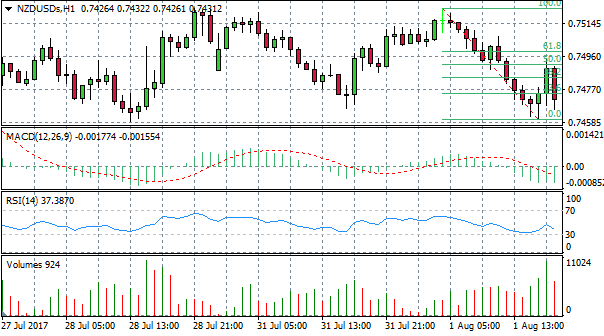

NZD/USD

The NZD/USD pair entered into a marked downtrend to start the trading week, however, the trend was reversed during yesterday’s trading session. A bullish run saw the pair hit and reject a resistance level at the 50 Fibo level which resulted in a strong sell-off. RSI has a sharp downward trajectory and MACD has crossed the zero line. Volume surged into the bullish move however, it appears that buyers have lost steam/sold positions as volume has dropped off into the bearish reversal.

Impact event: ADP Private Payrolls data released at 15:15 GMT+3 will impact all dollar pairs.

EUR/GBP

EUR/GBP has made a slow climb upwards as sentiment has switched from negative to positive especially during the Asian trading session. As a result, the pair has reached a strong resistance area at the 61.8 Fibo level. Given that RSI indicates that the asset is reaching overbought conditions and MACD remains below the zero line, the uptrend seems unlikely to continue. A bearish reversal may be indicated.

Impact event: GBP Construction PMI at 11:30 GMT+3 and EU Producer price data at 12:00 GMT+3.

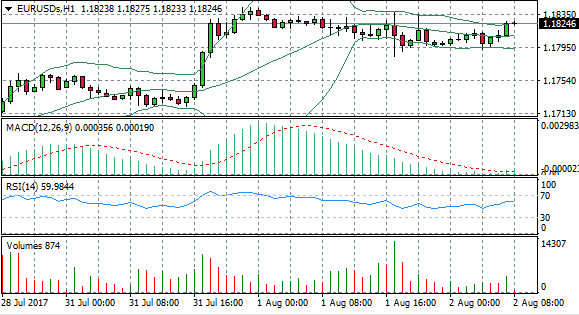

EUR/USD

The EUR/USD pair has broken the Upper Bollinger band in a marked bullish move after a period of ranging price action. To confirm overbought conditions, RSI has is approaching the 70 ‘resistance’ line. MACD also appears to be approaching the zero line indicating less conviction in bullish momentum. Volume has started to rise after a period of low volatility. Given the signals from momentum indicators is testing a previous support level at the 110.22 price level. Two doji candles at the resistance line indicate indecision in the market and clearly a break of this resistance level would give weight to the uptrend. The next target for price action will be the 110.37 price level. RSI has bounced off the 30 support area, yet MACD remains strongly in negative territory. Volume appears to be declining indicating there may not be enough support for the bullish move.

AUD/USD

The AUD/USD has reached and is both the 20 period exponential moving average and the 23.6 Fibo level. The pair’s ability to sustain the retracement will be dependent on the appetite of buyers of the Australian Dollar. MACD remains in negative territory however, RSI has an upward trajectory. The Aussie Dollar’s ability to outshine the U.S. dollar may not be sustained, specifically in the long run as monetary policy measures from the Federal Reserve will provide support for the U.S. dollar.