Daily Insights Report 03/08/2017

- 3 Aug 2017

USD/JPY

The USD/JPY pair is testing a former support line at the 110.74 price level and a break of this price level would confirm upward momentum. The outlook remains bearish however; as MACD remains below the zero line and RSI has a downward trajectory. Similarly, the 20-period EMA has a downward trajectory which suggests that bearish sentiment has stronger weighting over the pair. Alternatively, the pair could reject the price level at 110.74 and head towards the 109.25 price level.

Impact event: ISM Non-Manufacturing PMI data will be released at 17:00 GMT+3 and will likely impact all dollar pairs.

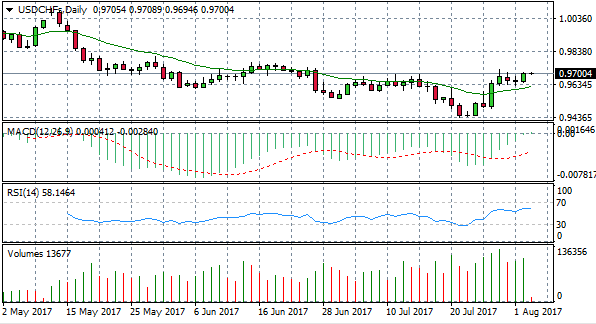

USD/CHF

The USD/CHF pair has broken the 20-period EMA and has continued a mild bullish rally. Volume appears to be climbing into the move suggesting strong appetite from U.S. Dollar buyers. MACD appears to be turning positive and a cross of the zero line will be a signal that the uptrend should continue. RSI has flattened below the 70 resistance line suggesting there is still some upside potential.

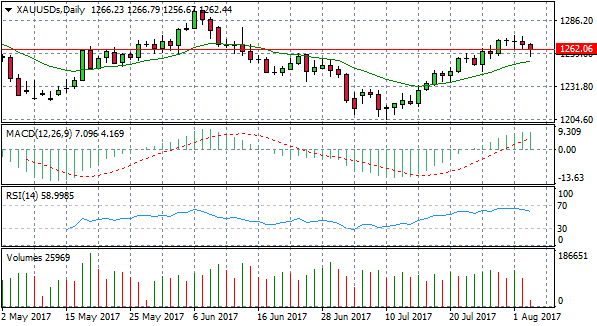

GOLD

After a sustained bullish run since the end of June, Gold buyers appear to have less conviction as denoted by the drop in volume in the two trading days. The asset appears to be testing the 1262 price level and a break of this price level will give weight to the downtrend. RSI appears to be moving off the overbought 70 area, however, MACD remains positive above the zero line. Price action also remains above the 20-period EMA which further confirms sentiment is swayed to the positive. Clearly, the price level at 1262 is significant and a rebound/break of this level will govern the near-term direction of Gold prices.

USD/CAD

The USD/CAD pair has hit and rebounded from the 30 support line on RSI and has had several candles closing above the 30 line. Momentum on MACD appears to be heading in a more positive direction and volume appears to be climbing into the move. The conviction from buyers will be tested by the 20-period EMA and whether price action is able to break above this level. If a break occurs, U.S. dollar buying will likely continue and the pair should move higher.