Daily Insights Report 07/07/2017

- 7 Jul 2017

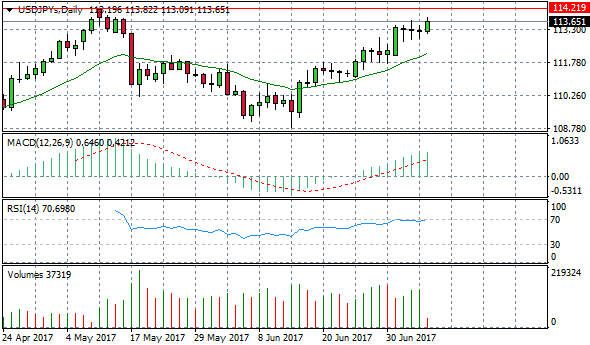

USD/JPY

The USD/JPY pair is displaying an ascending flag continuation pattern, with each horizontal move being followed by a strong bullish candle. This pattern indicates that the current uptrend should continue given the strong conviction from buyers to drive prices to higher highs. The 20-period exponential moving average also indicates that momentum is bullish, with a clear upward trajectory. Price action has reached a weak resistance area near the 113.76 price level and if it breaks this resistance line prices may continue to rise. A market top was reached at the 114.21 price level which would represent a strong resistance for the pair and likely be met with significant selling pressure.

Impact event: Non-Farm Payroll report will be released at 15:30 GMT+3 and will likely impact all Dollar pairs and Gold.

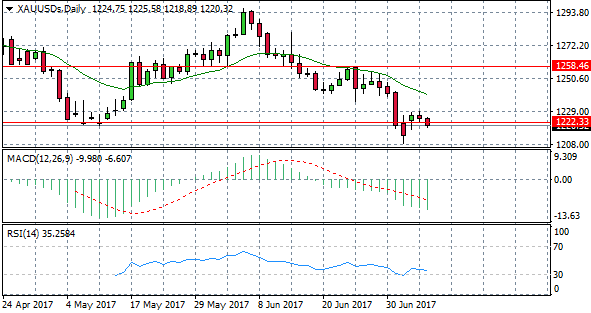

GOLD

A strong sell-off over the last week has Gold prices breaking a significant support area at 1222.33. Price action broke the support line, returned above the support line and is again testing the price level in today’s trading session. The brief pullback in price came as a result of fundamental factors: with indecision from the Federal Reserve’s policy committee regarding the impact of inflation on their forward guidance policy. The dollar weakened and Gold rose. Momentum still remains firmly bearish however, with RSI heading into oversold territory and MACD remaining negative.

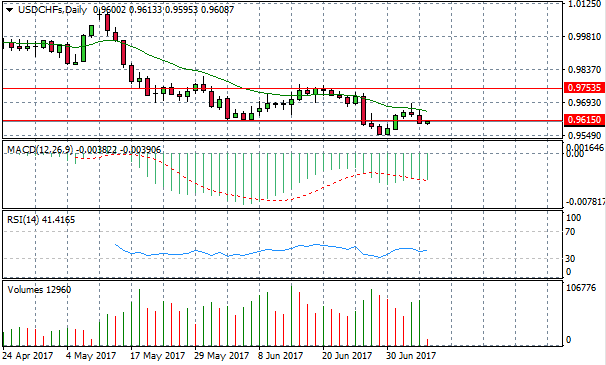

USD/CHF

The USD/CHF pair has been in a fairly marked downward trend since mid-May, as safe haven assets have fallen out of favour, in line with an increase in risk-on sentiment from investors. The pair appears to be testing a strong support area at the 0.961 price level having broken the support line in yesterday’s trading session. Trading activity rose significantly into the bearish move in the two previous trading sessions indicating sellers are dominating the pair. RSI has turned more bullish, however MACD appears to be flat in negative territory. U.S. employment data later in the day is likely to have an impact on the pair.

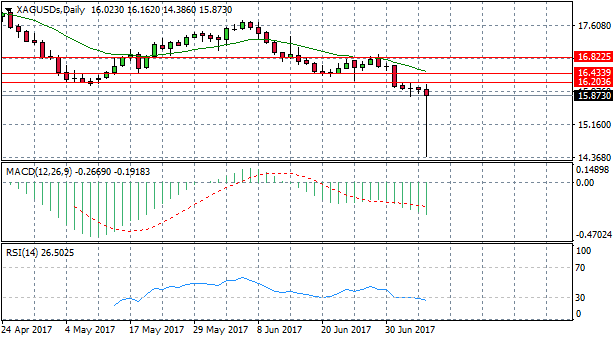

SILVER

Silver prices faced strong volatility in the Asian trading session as a result of what seems to be human error. Price dipped as low as 14.386 followed by a full recovery to current price level of 15.97 (at time of writing). Price action dipped below a significant support area at the 16.20 price level on the 3rd July and has continued the downward momentum since. MACD indicates that sentiment remains bearish with a descending trajectory below the zero line. However, RSI remains flat at the 30 oversold zone yet volume appears to be declining; indicating little conviction from buyers or sellers to push prices in one direction or another.