Eurodollar Heads Towards Recent Price Low

- 30 Aug 2019

USD/JPY

USD/JPY has rebounded from the 105.28 support level and is heading back towards the 107.16 resistance line. A new trading range between the 105.28 and 107.16 price levels has been established. Momentum indicators remain in bearish territory but are beginning upward trajectories.

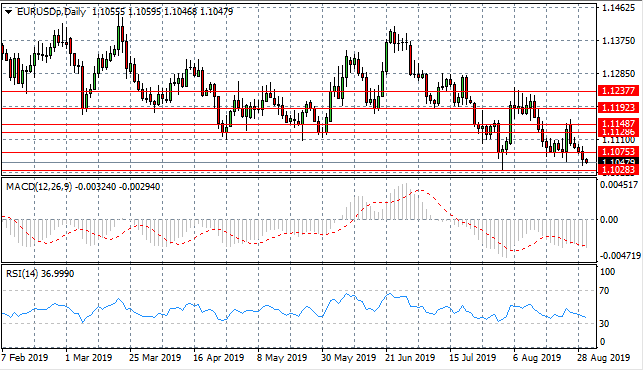

EUR/USD

The Euro continues to suffer from a strong sell-off in recent trading, taking price action to test the 1.102 price level which represents a recent price low. A longer-term downtrend appears to have been established for the pair. Momentum indicators remain in bearish territory with further downside potential.

GBP/USD

The GBP/USD pair had broken the 1.218 resistance line and has since returned to test the support area. A break would take price action back towards the 1.203 support level once again. Momentum indicators are bearish however MACD is approaching the zero line and RSI remains at the default line.

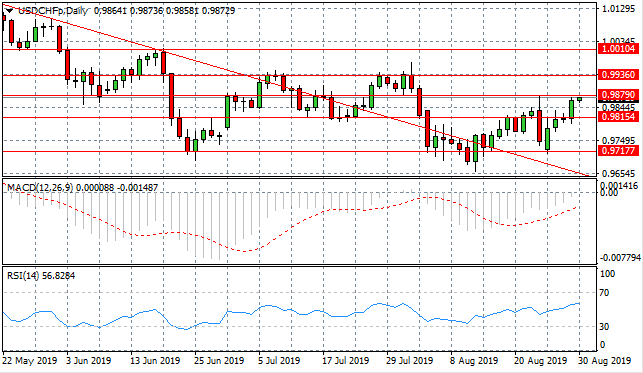

USD/CHF

The USD/CHF pair has found support and is now testing the 0.987 resistance line with the next resistance line at the 0.993 price level. The overall trend is downward for the pair with the occasional bullish rebound in price action. Momentum indicators have an upward trajectory with MACD verging on a bullish break of the zero line and RSI moving into the bullish channel.

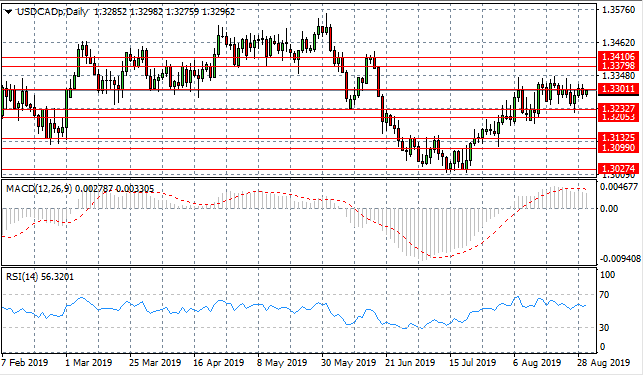

USD/CAD

The USD/CAD pair is unable to clear the hurdle of the 1.330 price level as selling pressure rises each time a break is attempted. Horizontal trading will likely continue until significant fundamental factors take hold. Momentum indicators are bullish with further upside potential.

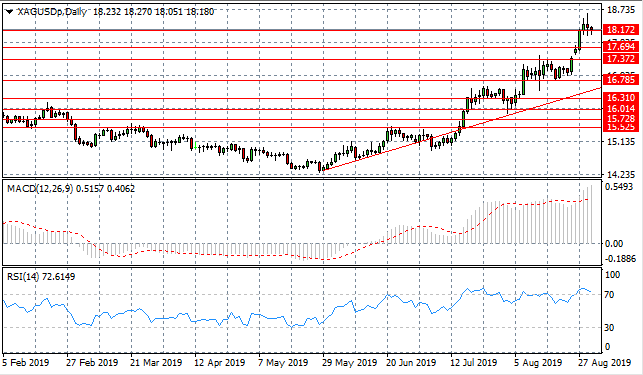

SILVER

Silver has broken the 18.17 resistance line in a strong bullish move. However, the break has been met with rising selling pressure and price action is once again testing the price level. MACD has extended further into bullish territory however RSI has reverted back towards the 70 overbought line.

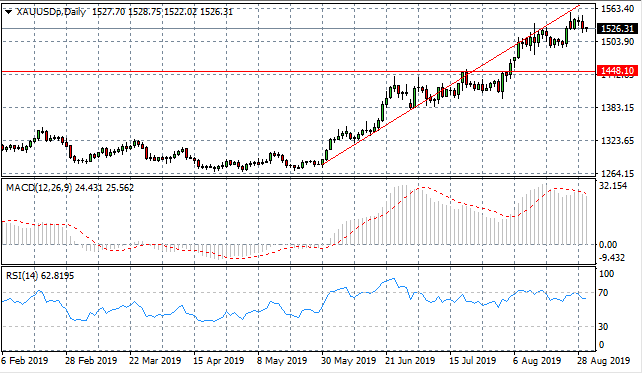

GOLD

Gold also appears to be pulling back from the extended rally and is no longer testing the ascending trendline. These signs of exhaustion in the rally may represent the end of the longer-term bullish sentiment. Momentum indicators remain in bullish territory yet momentum reversals appear to be underway.

OIL

WTI is testing the 56.69 resistance level with bullish price action rising. If buyers can push price action beyond the 56.69 resistance line, it may signify the end of the long-term bearish trajectory of the commodity. Momentum indicators are neutral if slightly bullish.