Daily Insights Report 13/03/17

- 31 Mar 2017

13 Mar 2017

It is likely that this week, investors and markets will be paying close attention to monetary policy as central banks in Japan, the US, and the UK all have scheduled meetings.

Japan’s core machinery orders fell unexpectedly by 3.2% month-over-month in January. This comes after a 2.1% rise that was seen in December. Orders for manufacturing fell by 10.8% while orders for non-manufacturing increased slightly by 0.7%.

– The Dollar index, which tracks the Dollar against a basket of currencies was up 0.1% at 101.31. The US Dollar s

– The UK pound was flat against the Dollar at 1.2166. Markets predicted that the Pound would actually weaken because it is believed that Theresa May could trigger Article 50, which is the procedure for Brexit as soon as Tuesday.

– The Japanese Yen weakened 0.1% to reach 114.88 per Dollar.

Commodities

– Oil continues to fall below the $50 level. This comes after US drillers continued to increase their activity. ExxonMobil, for example stated that they will add 45,000 construction and production jobs for projects along the Gulf of Mexico coast. Futures contracts also fell for oil, by almost 9.1%.

Japanese Yen (JPY)

Industry Activity Indexes (January)

The expectation for this data is to grow by 0.4%. This represents the Japanese tertiary sector of commerce. The increase of 0.4% comes after it fell 0.4% in December. Consumer and business expectations have risen since the beginning of the year, so it is likely that an improvement can be seen among different business orientated services. There has been an increase in retail trade since the beginning of the year, which forms a large component of industrial activity. For this reason, it is likely that we will see an increase in the data as well.

United States Dollar (USD)

Producer Price Index (February)

The pull down of oil prices may lead the Producer Price Index unchanged in February. This comes after the index increased for three consecutive months. For the PPI to increase further, it would need to come from the labor market through higher costs. This would force companies to incur higher costs, thereby increasing the PPI.

Technical Analysis

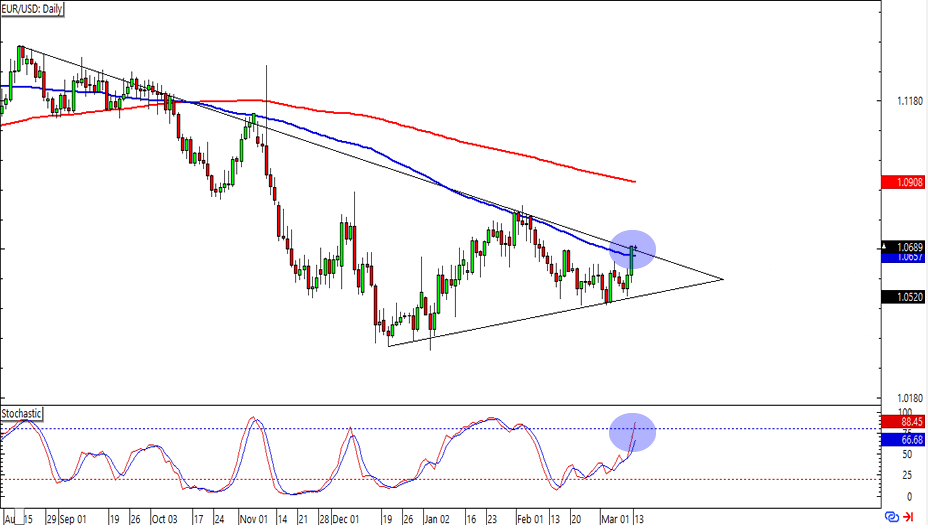

EURUSD

By volume, this may be the most traded currency pair. For this reason, the spreads are always razor thin. Looking at the daily chart of this currency pair, and paying close attention to the SMAs, can see the pair is hovering around the 1.070 level which is in the middle of the trend and resistance level. The stochastic indicators show that the pair is in overbought territory. For this reason, traders may be looking for a downside move. The symmetrical triangle does lead to uncertainty as it is unclear where it what direction it could break out from. Though looking at the economic calendar, the USD may appreciate this month because of the interest rate and oil prices may attract buyers of the Dollar.