Daily Insights Report 16/05/17

- 16 May 2017

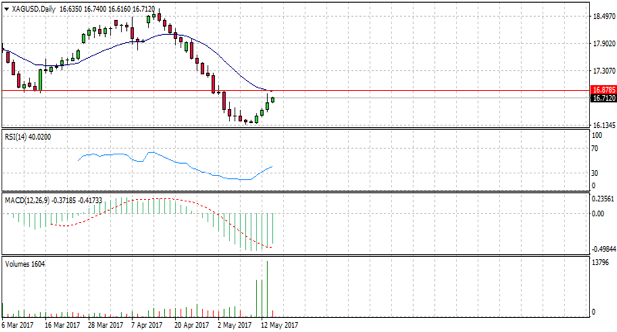

SILVER

Silver appears to have bounced back after an extended sell-off in April. Heavy volume has supported the reversal in trend and price action appears to be heading towards the 16.878 level. Several candles have closed above the RSI 30 zone indicating the asset has turned bullish from an oversold position. MACD also confirms the change in momentum.

Impact event: Eurozone GDP data is due to be released at 16:00 GMT+7.

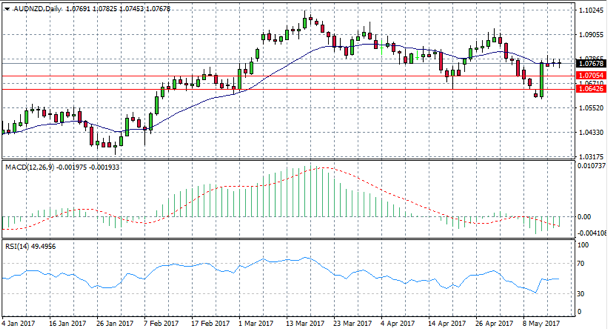

AUD/NZD

The AUD/NZD pair appears to be holding at the 20 day exponential moving average (EMA) with a series of doji candles, indicating indecision in the market. MACD confirms a long-term bearish trend which has turned more negative in the last week of trading. If the pair manages to break the 20-day EMA then the next price target will likely be 1.0705, representing a previous support.

Impact event: The Global Dairy Trade Auction may impact NZD.

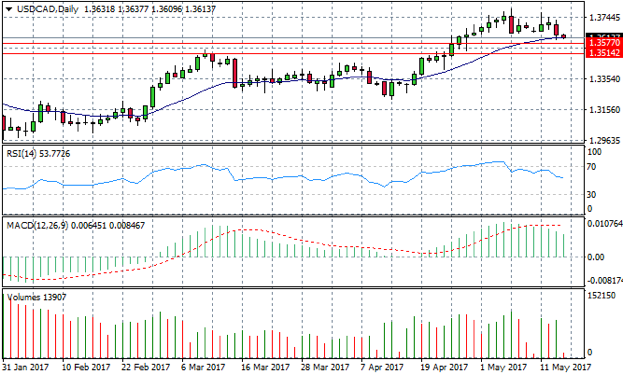

USD/CAD

The USD/CAD appears to be coming off an overbought area. Price action is touching the 20day EMA and the pair’s ability to break or bounce off this area will determine the near-term direction. If price action breaks the EMA, the next target will be the support level of 1.3577. Both RSI have downward trajectories indicating that momentum is currently bearish.

Impact event: U.S. Building permits data will be released at 19:30 GMT+7.

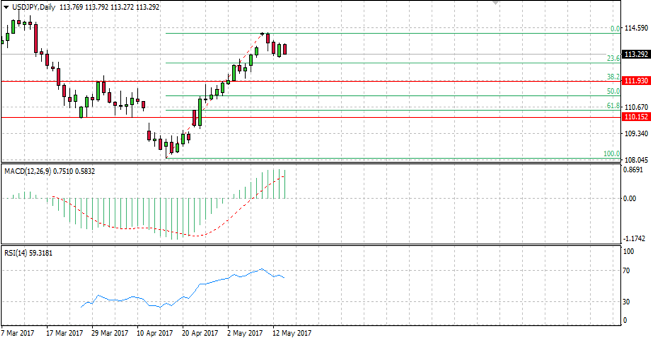

USD/JPY

Buyers of the dollaryen appear to have lost steam and a ‘top’ has been reached with the pair which has now retraced back off the overbought area (according to RSI). Momentum appears to be low, with price action flat lining around the 113 price level. If price action continues to retrace and break the 23.6 Fibo level, momentum may carry the pair towards the 111.93 level.

Impact event: U.S. Building permits at 19:30 GMT+7.