Daily Insights Report 19/01/17

- 31 Mar 2017

19 Jan 2017

Australia’s jobless rate reached a 6-month high of 5.8% for December. The unemployment level has risen over the last two months, which may begin to be a cause for concern. This is the highest level of unemployment since June of last year. The market predicted 5.7%, which was the same as the previous month of November. The economy is believed to have added 13,500 new jobs but at the same time the number of unemployed rose by 14,800.

The Pound’s 3% rally in the previous day quickly ended and the currency moved the opposite direction. The Pound fell 1.2% against the Dollar to reach $1.2268. It could be that the Dollar and Pound is accurately priced as the fears of Brexit are now understood and absorbed into the current price. The GBPUSD pair may some stability prior to Donald Trump formally taking the role of President. Looking at the long term, the Pound may see more volatility against the Euro compared with the Dollar. Janet Yellen gave a speech about the fiscal policy over the coming years. She mentioned that she expects to tighten the monetary policy a few times a year through before 2019.

Commodities

– Oil prices had a uneven session with WTI crude falling 2.7% to reach $51.30 per barrel. Similarly, Brent crude rose as high as $55.90 before settling down at $53.92 (a fall of 2.8%). The fall in these prices comes after the International Energy Agency predicted that shale output from the US had increased, thereby undoing the price change brought on by OPEC’s new output agreement.

– Gold’s seven-day rally ended and lost 1.1%. The Dollar’s rebound in value brought the metal down $12 and then reached $1,204 an ounce.

Australian Dollar (AUD)

Employment

The forecast for this data is at 5.7%. While unemployment is not rising and there is evidence of new jobs being created, reports show that many of the new jobs are in fact part-time positions. Australia’s service economy has been showing signs of growth. A rise in the service industry has only been possible because of an accommodating labor market.

United States Dollar (USD)

Housing Starts and Building Permits

Housing Starts shows the total number of new residential buildings on which construction began in the previous month.

Housing starts are expected to have increased in the month of December. Housing permits increased drastically in the three months before November, so logically housing starts should have risen as well. These are both considered to be important indicators together as they show the state of the housing market in the US, and the employment situation. It has become more closely watched since the financial crisis of 2008 that was mainly brought by the housing market crash.

Technical Analysis

Gold

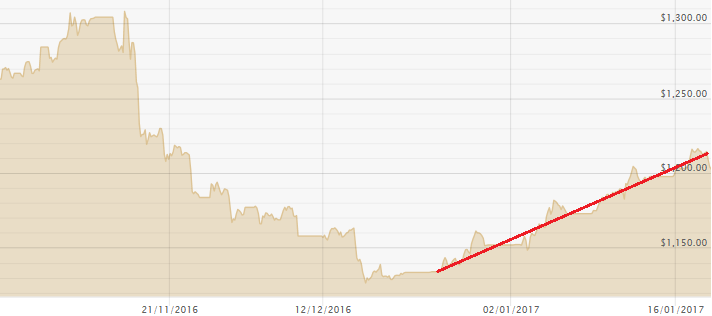

The event of the election and the Fed raising interest rates has been of key importance for the price of gold. While the price has fallen in the past three months, the value has been picking up almost consistently for over a month. Over the last few weeks, the price of gold has increased and remained within what looks like a confining band, which is shown in the above graph by the red line and the below graph in more detail.

The bullish channel being seen for the last few weeks. Looking at the Fibonacci retracements, the 50% level from the time of the election is $1,230, and recently it has been climbing in that direction, with some resistance – most notably – yesterday’s trading session. For a bullish trader, if the value stays in the band of $1,200 to $1,204, it would be an appropriate time to set up a position. However for those who may be bearish traders, they should be interested for gold to break the support level of $1,187.50 on the way down for a downward trend to continue.