Daily Insights Report 20/01/17

- 31 Mar 2017

20 Jan 2017

China is expected to release a series of important data today. As long as growth forecast figures do not fall from the 6.7% expansion of the fourth quarter, global markets should behave normally. Because of China’s importance in the global marketplace, many markets rely on China’s stable growth to continue to grow.

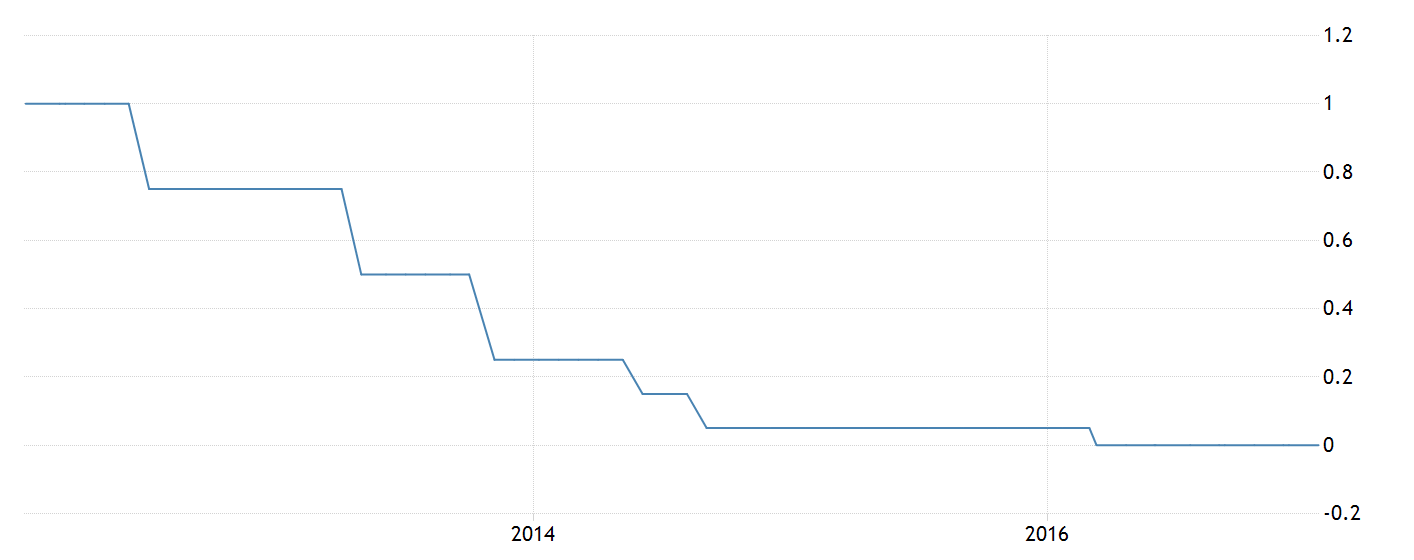

The ECB (European Central Bank) announced yesterday that they would leave the refinancing rate at 0%. It also said that they would leave their monthly asset purchases at 80 Billion Euros a month until March, at which point it will be changed to 60 Billion Euros a month until the end of this year. What was said in Mr. Droghi’s speech is quite contrasting with what Janet Yellen said about the same topic about the US economy. She said that the US would risk seeing a “nasty surprise down the road – either too much inflation, financial instability, or both” if interest rates were delayed and not the wait for increasing the rate is too long. Over the past 5 years, the interest rate of the collective Euro Zone has continued to fall. It can be seen below.

The incoming Secretary for the US Treasury, Steven Mnuchin (a former banker from Goldman Sachs) has expressed support for a strong Dollar. This comes a few days after the President-elect said that the Dollar was in fact too high, and as a result less competitive. Mnuchin mentioned that the comments earlier in the week were more so about short-term market fluctuations, rather than the long term. This event suggests that financial markets may see more volatility because of ambiguity of the overall message that the President will have about different issues. Even though he is a controversial choice for some because of his career, he will assume a very important role in the US government.

Commodities

– Oil prices were higher even after news of US crude inventories had risen again. This is now the second consecutive week where it has risen. West Texas Intermediate (WTI) crude was up 0.6% and reached $51.37. At the same time, Brent crude rose settled at $54.16.

– Gold’s price grew by $1 and remained at $1,205 an ounce for a while. This comes after it touched $1,196

British Pound (GBP)

Retail Sales (December)

With the event of Brexit looming in the near future, retail sales can show consumer optimism through a different lens. It is likely that in monthly terms sales fell by 0.5%. Though looking at yearly data, it is likely that sales grew by 6.6% compared with December of last year. Data that was released recently about private sector data show that sales have slightly dipped. This must be looked at carefully because private sector data measures the aggregate sales in value terms, and reports the revenue from the sales. They do not mention the price of goods, which has also grown in the past few months. Because of these two conflicting factors, it is more likely that sales in terms stayed more or less unchanged.

Quarterly data is likely to show that spending remained relatively healthy even though there is uncertainty about the future with Brexit. This is because the Christmas shopping season, which likely added 1.85% to retail sales. Retail sales should weaken in the coming months, as the increase in inflation will eat into purchasing power since wage growth has not kept up to the same speed. People may choose to increase their saving in the coming months, which, without a rise in wages, can only mean that retail sales will fall.

Technical Analysis

USDJPY

When the USD moves, it moves the JPY as well. Looking at the events of the USD this week including Donald Trump’s comments and Janet Yellen’s speech about the fiscal situation of the country, the value of the Yen moved in opposite directions as well. Comments about the US Fed increasing interest rates in the near future gave some headwind to the Dollar, and as a result yields on treasury and USDJPY rose as well.

Looking at the 1-year chart below, we can see how the value of the Yen has changed. While there are events regularly that cause fluctuation, the overall trend in recent months is that the USD is strengthening against the Yen. Though this might slowing, as we can see from the moving average curve (in red). With the MACD also crossing the 0 line, it shows that the moving average is beginning to converge.

For a holding position, it would suggest to hold the currency if the value reaches 115.50, through to the 119 level. This was the value that was trading around the US election period. The Fibonacci retracement of 38.2% is at 110, which would signal a reverse in the direction, if this resistance level is reached.