The Eurodollar Is Consolidating Ahead Of Draghi’s Speech

- 19 Sep 2018

How can you diversify your trading with indices? Join Lauren on 28Sept to learn more now.

USD/JPY

The USD/JPY pair has cleared the 111.81 and it remains to be seen whether the pair can reach the 113.26 resistance line. Momentum indicators are bullish; however RSI is approaching overbought conditions.

EUR/USD

The EUR/USD pair has broken the 1.164 resistance level and may be headed towards the 1.173 price level, however, the pair has failed to truly test this resistance level in recent trading. Momentum indicators are moderately bullish.

Impact event: Mario Draghi will give a speech at 13:00 GMT and statements will likely impact Euro pairs.

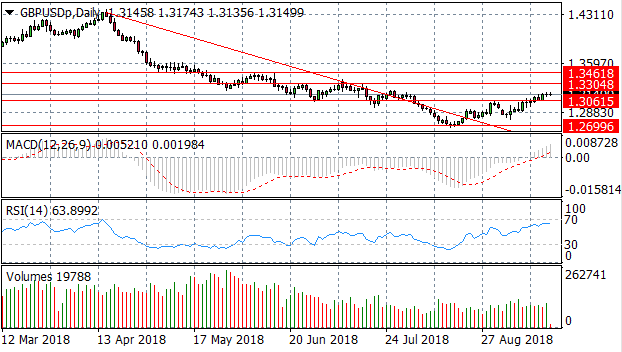

GBP/USD

The GBP/USD pair has finally broken the 1.306 price level to upside and the next target for buyers remains at the 1.330 price level. MACD has broken the zero line and yet RSI is fast approaching overbought conditions. The bullish run may not last.

Impact event: UK CPI data will be released at 08:30 GMT and will impact all GBP pairs.

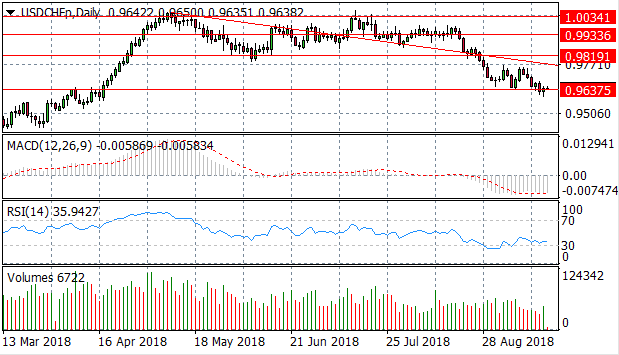

USD/CHF

The USD/CHF pair is still being held up at the 0.963 price line, despite a mild break of the key support level in recent trading. Momentum indicators are flat- with MACD stalled in bearish conditions and RSI is bouncing along the 30 oversold level.

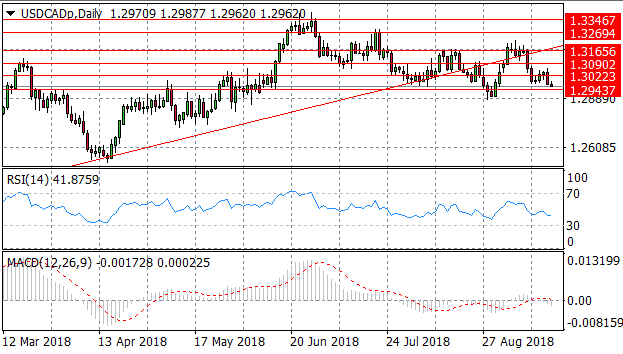

USD/CAD

The USD/CAD pair has been unable to fully break the 1.302 price level in recent trading as a bearish bias has once again taken hold. Momentum indicators have turned bearish with MACD breaking the zero line and RSI continuing a downward trajectory.

SILVER

Silver is testing the descending trendline which has represented a strong resistance line since May. Each time price action has approached, it has rejected and price action has fallen back to the long-term downtrend. Currently, momentum appears to be turning more bullish.

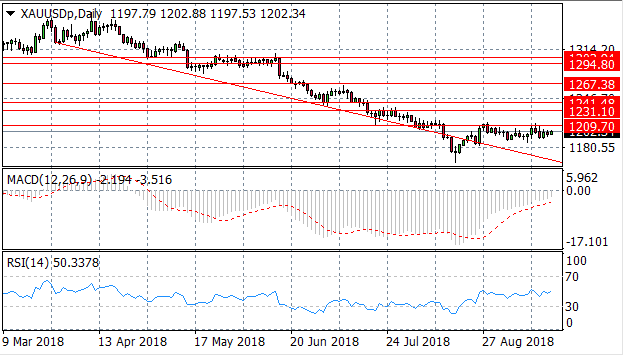

GOLD

Price action continues to consolidate just below the 1209.70 support level. A series of doji candles indicates indecision from Gold traders. Momentum indicators are neutral if slightly bearish.

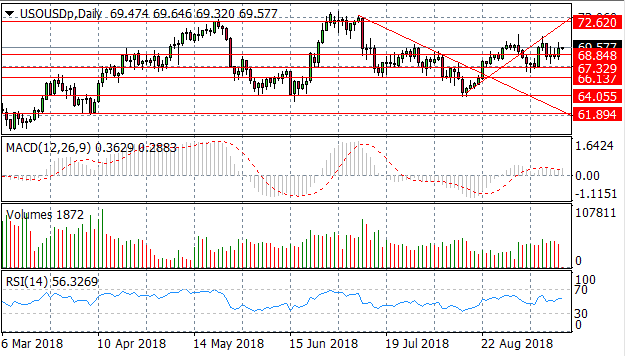

OIL

Oil price volatility continues with a potential new trading range being created for the commodity between the 67.32 and 69.57 price levels. Momentum indicators appear to have a bullish bias.