Daily Insights Report 08/03/17

- 31 Mar 2017

8 Mar 2017

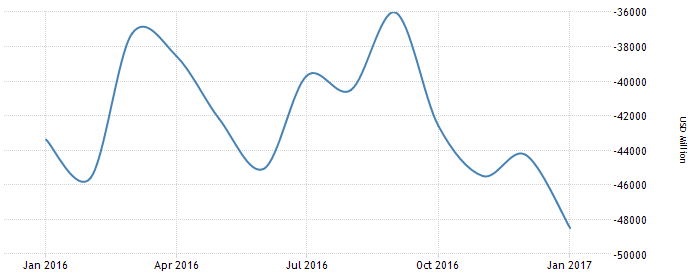

In the US, the goods and services deficit widened to USD 48.5 billion in January from USD 44.3 billion in December. Data showed that imports increased by 2.3% due to higher shipments of consumer goods and oil. Exports grew as well, but at a much more modest pace of 0.6% growth. This is the largest trade gap seen in the US since March 2012. Goods and services data from the US is sought after data because of the position of the country as a major trading partner for so many countries. A look at how the deficit has progressed in the last year can be seen in the graph below.

– The Euro fell 0.2% to 1.0566. This is likely due to news that German factory orders fell sharply in January. Traders await the ECB to announce their monetary policy decision on Thursday.

– The GBP fell 0.3% to a seven-week low of $1.2205. This comes after the government will present a Budget presentation and the existing Brexit concerns remain in place.

Commodities

– Gold was down 0.2% and reached $1,213 an ounce. The metal had hit a four month high of $1,264 just six sessions ago. However, because interest rate rise expectations have climbed.

– When looking at recent levels of oil prices, it can be seen that oil prices have been fluctuating in a band since OPECs meeting and decision to alter member’s outputs. Brent was down 0.6% and reached $55.65 a barrel.

Euro (EUR)

Germany Industrial Production (January)

Germany’s industrial production likely saw a period of recovery in the start of 2017, and rose 3% month-over-month in January after it had slightly fallen in December. Considering yearly data, it is lower than what it was a year ago.

In December, manufacturing orders increased 5.2% month-over-month. Similarly, Markit manufacturing in January rose to a 65 month high to 56.4 from 55.6 in December. This data points that there will likely be better business conditions in the coming months.

Demand from outside the Euro area should strengthen in the coming months thanks mainly to the recent depreciation of the Euro. The input from the US is not certain as protectionist policies from the US could have a negative impact on German manufacturing.

Spain Industrial Production (January)

Spain’s industrial production likely rebounded in January after contracting in December. A rise of 2.7% year-over-year is expected. The manufacturing PMI suggested a strong expansion, and additionally more new orders. The survey also showed new jobs being filled. Even though the PMI number for February slightly decreased, it remained well into what can be seen as an expansion.

Strong PMI readings in the single-currency zone mean that there will be a higher demand for Spain’s exports. With Spain recently demonstrating promise for the future, business sentiment also continues to grow. This is evident as business sentiment recently showed a positive reading for the first time in 18 months.

Recently, energy prices have increased and this contributed to inflation reaching 3.0 percent in February. Input prices in the form of material costs may encourage producers to hold stocks and increase inventory of them. This may increase output in the short/medium run. Inflation costs will ultimately weigh in on consumer demand. Even though the economy remains in a healthy shape, growth may not last into the long term.

Technical Analysis

AUDCAD

Looking at the one hour chart of this currency pair, we can see that the pair is currently trading around the mid channel support. Entering a trading position now at current levels with the expectations of the AUD appreciating against the CAD may be profitable. Both periods of moving averages are currently below the pair. Upcoming on the economic calendar is more oil information that is likely to directly impact the CAD and weaken it against the EUR.